Kaalaadhan: Luxembourg Pepsi and other Multinational companies ghotala resulting in losses in corporate tax collections![]() Sachin Tendulkar, MP in a Pepsi Ad.One address in Luxembourg where 1600 Multinational companies listed- As in many tax havens, a Luxembourg office can be just a mailbox. Office buildings throughout the city are filled with brand-name corporate nameplates and little else. Some have offices and no visible employees. One building at 5 Rue Guillaume Kroll is home to more than 1,600 companies; another at 2 Avenue Charles de Gaulle houses roughly 1,450; and a building at 46A Avenue J.F. Kennedy is home to at least 1,300, according to an ICIJ analysis of Luxembourg’s corporate registry.

Sachin Tendulkar, MP in a Pepsi Ad.One address in Luxembourg where 1600 Multinational companies listed- As in many tax havens, a Luxembourg office can be just a mailbox. Office buildings throughout the city are filled with brand-name corporate nameplates and little else. Some have offices and no visible employees. One building at 5 Rue Guillaume Kroll is home to more than 1,600 companies; another at 2 Avenue Charles de Gaulle houses roughly 1,450; and a building at 46A Avenue J.F. Kennedy is home to at least 1,300, according to an ICIJ analysis of Luxembourg’s corporate registry.

Sachin Tendulkar, MP in a Pepsi Ad.

Sachin Tendulkar, MP in a Pepsi Ad.![Rue Guillaume Kroll.]() This address in Luxembourg is home to more than 1600 companies. Photo: Delphine Reuter

This address in Luxembourg is home to more than 1600 companies. Photo: Delphine Reuter

These companies can represent big bucks. From the U.S. alone, direct investment into Luxembourg in 2013 was $416 billion, according to the U.S. Bureau of Economic Analysis. Of that, the vast majority, $343 billion, was in the form of holding companies, which are vehicles to hold securities and financial assets rather than to create local jobs. In fact, Luxembourg represents a tiny fraction of 1 percent – 0.13 percent in 2010 – of all overseas jobs with American companies, indicating it is a place that houses money more than it provides employment.

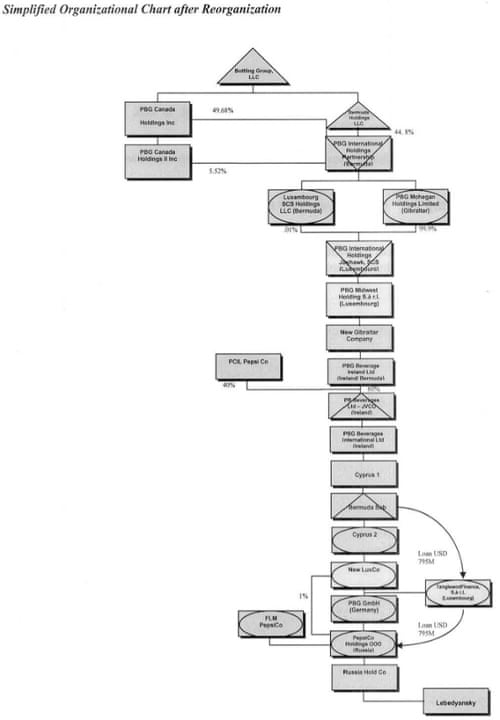

PwC sells Luxembourg as a place with “flexible and welcoming authorities” who are “easily contactable” and offer a “quick decision-making process”The documents show that:The Pepsi Bottling Group Inc., a New York-based unit of PepsiCo, used subsidiaries in Luxembourg to arrange a series of loans among sister companies that allowed the bottler to reduce its tax rate on its $1.4 billion purchase of a controlling interest in JSC Lebedyansky, Russia’s largest juice maker. At least $750 million of the money involved in the Russian deal traveled through a Luxembourg subsidiary named Tanglewood, before landing in a Pepsi subsidiary in Bermuda. Luxembourg acted as a tax-reducing conduit as the profits moved from Russia to Bermuda.

http://www.icij.org/project/luxembourg-leaks/leaked-documents-expose-global-companies-secret-tax-deals-luxembourg

Pepsi: somewhere in there one of those companies bottles soft drinks.

Pepsi used subsidiaries in Luxembourg to arrange a series of loans among sister companies.

This method was to reduce its tax rates. Money travels through Luxembourg subsidiaries to show cooked up Profit and Loss Accounts to arrive at the bottom line, PROFIT which is subject to Corporate tax in countries like India.

Thus, Pepsi was allowed to use Luxembourg-India Double Taxation Avoidance Treaty to act as a tax-reducing conduit as the profits moved out of India into head-spinning organization charts of the type shown in 12 cases (loan charts shown below).

In the G20 summit, this will become a major subject for decision. India should take a stand. India, that is Bharat, should announce revision of its Corporate Taxation structure in such a way as to tax NOT on the profit/loss shown as bottom line in the Balance sheet but as a fair share of the turnover of a company due to operations in the territory of Bharat, that is India. For example, if Pepsi sells X number of bottles in Bharat, tax will have to be paid on the sales amounts recorded by Pepsi India.

This revision should be endorsed by G20 summit to overcome the ghotala caused by tax havens such as Luxembourg which is the size of a Panchayat in India. Double taxation Avoidance Treaty with Luxembourg should be so interpreted by India as to ensure that fair taxes are levied and collected from the companies showing fictitious links among sister companies with Luxembourg address used merely as ‘tax planning’ conduits which is a euphemism to avoid paying taxes to Indian Treasury.

Kalyanaraman

ACCOUNTING FRAUD OPENS CAN OF WORMS

Saturday, 08 November 2014 | PNS | New Delhi

At a time when the issue of black money is hogging headlines in India, the International Consortium of Investigative Journalists (ICIJ) on Thursday came out with an exposé on how the world’s biggest four consulting firms help the corporates siphon money to tax havens to evade taxes. The ICIJ, which accessed email conversations and sensitive Government records of tax havens, exposed how PwC, KPMG, Ernst & Young and Deloitte helped their various clients in moving out the money to several tax havens.

In the expose, ICIJ said, “For more than a decade, tax gurus at PricewaterhouseCoopers (PwC) helped Caterpillar Inc., the US heavy equipment maker, move profits produced by its lucrative spare-parts business from the US to a tiny subsidiary in Switzerland.” The investigative journalists’ organisation had accessed emails between Thomas F. Quinn, partner of PwC and Caterpillar’s top executives and found out shuffling of eight billion dollars’ transfer from US to Swiss.

“Thomas F. Quinn, a PricewaterhouseCoopers partner who helped design the tax-savings plan, wrote a PwC colleague that if they wanted to keep the strategy alive, they needed to “create a story” that “put some distance” between the managers and the spare-parts business. “Get ready to do some dancing,” Quinn said. The colleague, managing director Steven Williams, replied: “What the heck. We’ll all be retired when this … comes up on audit. … Baby boomers have their fun, and leave it to the kids to pay for it,” - said the ICIJ report exposing PwC.

ICIJ said in Luxembourg (a tax haven), internal company documents reviewed by them show, “PwC helped Pepsi, IKEA and other corporate giants from around the world embrace inventive profit-shifting strategies that allowed them to collectively slash their tax bills by billions of dollars.”

“In the US, authorities charged, KPMG peddled offshore tax shelters that created billions of dollars in fake losses for rich clients, then misled the Internal Revenue Service about how the shelters worked. In Dubai, anti-corruption advocates claim, Ernst & Young helped the Middle East’s largest gold refiner obscure practices that may violate international standards aimed at combatting trafficking in “conflict gold,” which comes from regions where competition for the mineral breeds bloodshed.

“In New York, authorities charged, Deloitte helped a British bank violate sanctions against Iran, submitting a “watered-down” report to regulators that omitted information about how the bank might be evading money-laundering controls,” said the ICIJ’s expose on the Big 4 consulting firms in the World.

Terming these Big 4 consulting and accounting firms as “architects of offshore money maze”, ICIJ said in its detailed report that these companies operate 81 offices in tax havens across the world. Deloitte employs around 150 people alone in the tiny English Channel islands of Jersey and Guernsey.

Confidential documents obtained by the ICIJ exposed that the Big 4 firms had a close relationship with Portcullis TrustNet, a Singapore-based offshore services firm that sets up hard-to-trace offshore companies for clients around the world. “PwC, for example, helped incorporate more than 400 offshore entities through TrustNet for clients from mainland China, Hong Kong and Taiwan, the records show.,” said ICIJ.

In June 2013, ICIJ had exposed 10,000 illicit bank account holders in British Virgin Islands and Singapore. The names of as many as 500 Indians figured in it. However, Indian agencies have not yet acted on this expose, though the list clearly mentioned names with addresses in India and accounts in foreign banks.

The Special Investigation Team (SIT) on black money trail is still seized with data provided by German and France authorities in 2011. In the 2G scam investigations, the Enforcement Directorate has sent LoRs to several tax havens including Singapore, Switzerland, Mauritius, Cayman Islands and Malaysia in search of money trails.http://www.dailypioneer.com/nation/accounting-fraud-opens-can-of-worms.html

12 LuxLeaks diagrams that will make your head spin

The Luxembourg tax leak this week showed how multinationals sought tax deals in Luxembourg which in some cases had the effect of saving them large amounts in tax. Submitted as part of many proposals were diagrams explaining current or proposed corporate structures (not always for tax avoidance purposes, though they were always writing to the taxman). These diagrams have a visual charm all of their own, and here we pick out twelve of the best. Look out for IFLs (interest free loans) and IBLs (interest bearing loans). When one turns into the other, it’s the cutest thing. And highly convenient for tax planning

Friday 7 November 2014 16.05 GMT

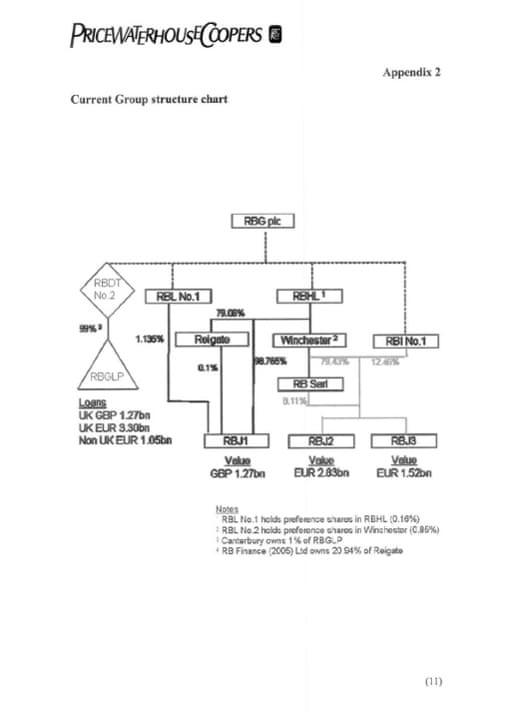

Reckitt Benckiser. The consumer goods company is behind brands such as Dettol, Air Wick and Vanish. Its diagram is appropriately tidy.

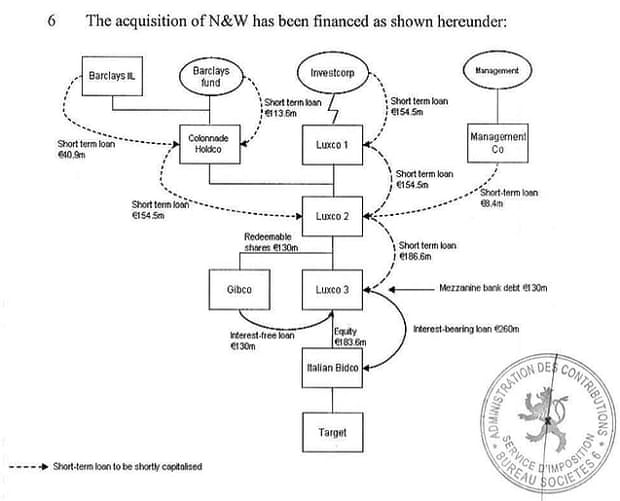

Barclays. This diagram explains how the bank was involved in the acquisition of a drinks vending machine company, in partnership with Investcorp, ‘a provider of alternative investment products’.

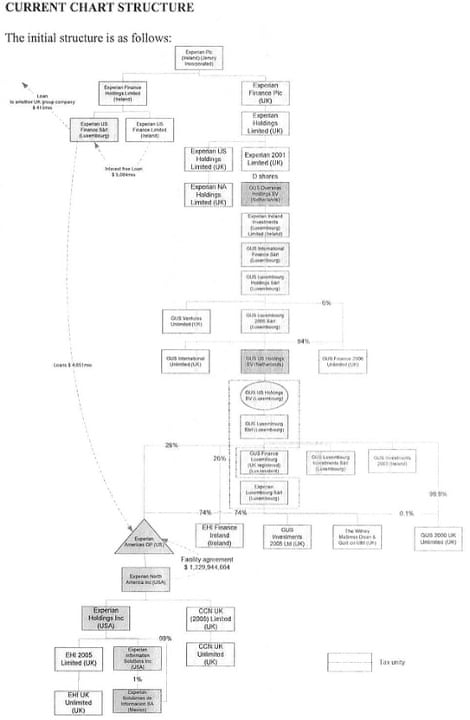

Experian. Insert joke here about how you’d have to be a ‘credit expert’ to interpret this initial structure.

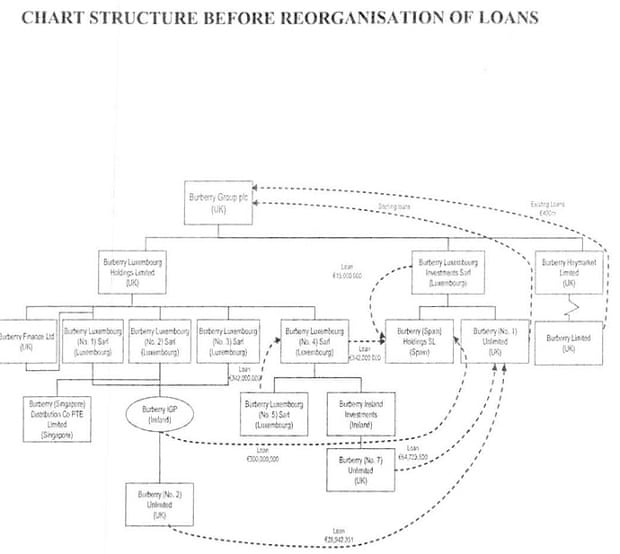

A complex and unique pattern, instantly recognisable to the cognoscenti. It’s Burberry.

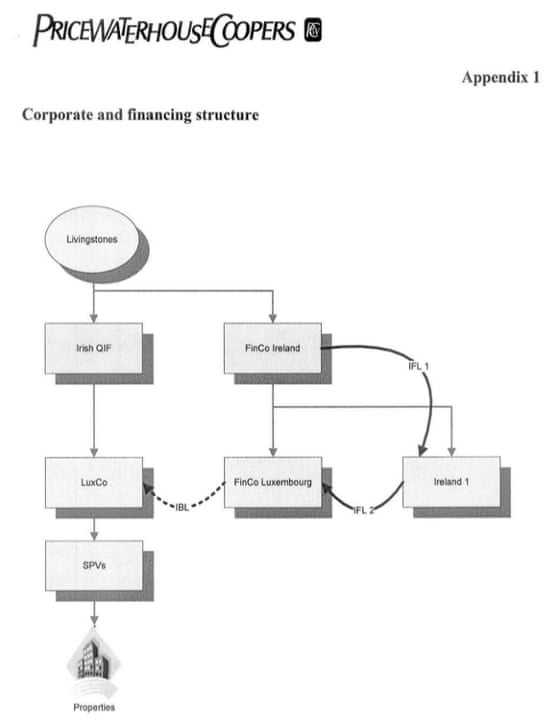

The Livingstone brothers, who are behind London & Regional Properties, a mammoth real esate group. A daring use of drop shadow and a rare note of clarity - that the money is eventually used to buy actual real estate - enliven this example.

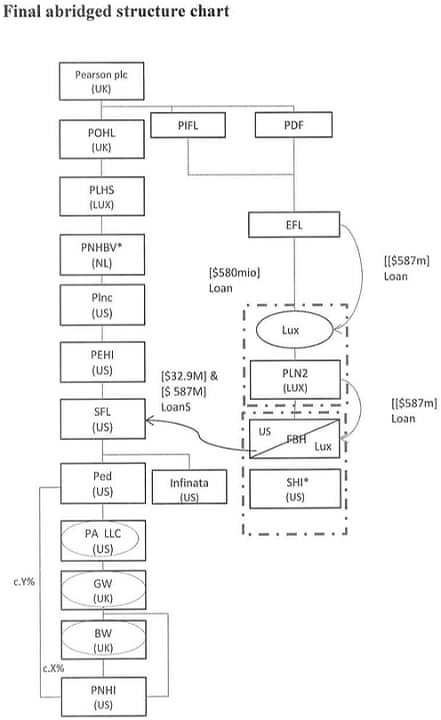

Pearson. A textbook example, so to speak. This one demonstrates the relationship between Pearson plc and Pearson Education in the United States. Among other relationships. (Pearson also owns the FT. Other media owners listed in the leak include Guardian Media Group, which owns the Guardian.)

Northern and Shell, the media company led by Richard Desmond, publishers of the Express stable and OK! magazine. Motto: Forti nihil difficile - “nothing is difficult to the strong”. Which must have been of some comfort to the tax authorities when they came to interpret the diagram.

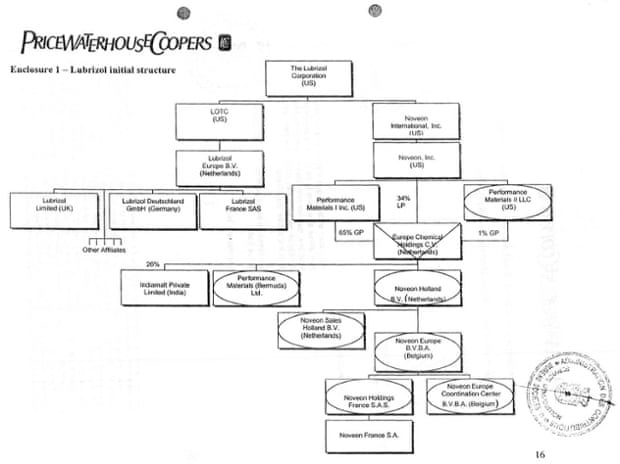

Lubrizol, a specialised chemicals manufacturer, owned by Warren Buffett’s Berkshire Hathaway. You won’t need us to tell you the difference between a rectangle, a rectangle containing an ellipse and a rectangle containing a triangle.

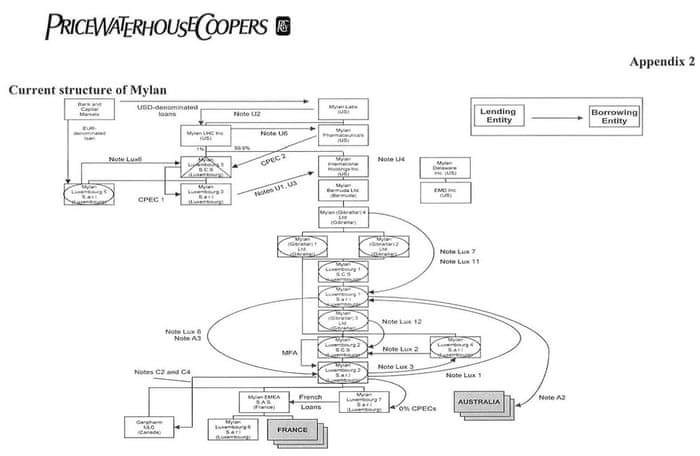

Drugs group Mylan is one of a string of US drugs firms to recently announce a ‘corporate inversion’takeover that will see its headquarters switch overseas, unlocking huge tax savings. As if its corporate family tree wasn’t complicated enough, Mylan now plans to be headed by a holding company in the Netherlands.

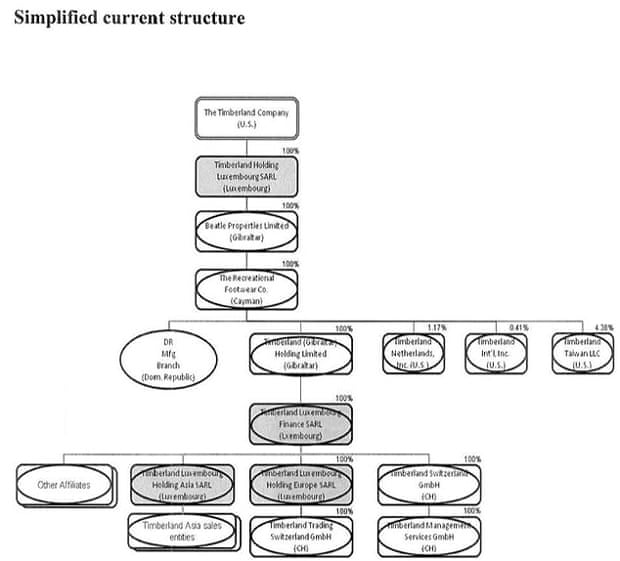

With exceptional good manners, this diagram for shoe company Timberland highlights which of the companies in the structure are in Luxembourg.

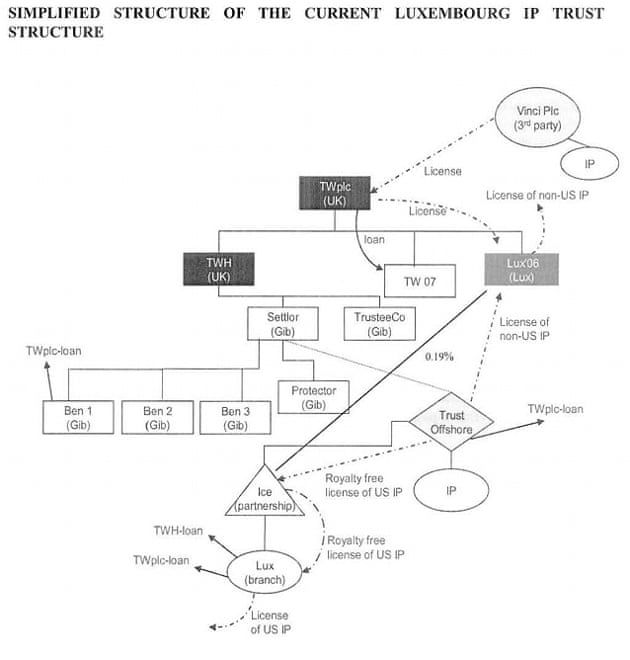

Taylor Wimpey, the house builder. TW at the time built most of their houses in the UK, US and Spain; none in Iceland or Luxembourg, where they had corporate entities involved in licensing intellectual property.

Photograph: Guardian

http://www.theguardian.com/business/gallery/2014/nov/07/12-luxleaks-diagrams-that-will-make-your-head-spin?index=1

Leaked Documents Expose Global Companies’ Secret Tax Deals in Luxembourg

Image: Tim Meko / Shutterstock

The landlocked European duchy has been called a “magical fairyland” for brand-name corporations seeking to drastically reduce tax bills.

Pepsi, IKEA, FedEx and 340 other international companies have secured secret deals from Luxembourg, allowing many of them to slash their global tax bills while maintaining little presence in the tiny European duchy, leaked documents show.

These companies appear to have channeled hundreds of billions of dollars through Luxembourg and saved billions of dollars in taxes, according to a review of nearly 28,000 pages of confidential documents conducted by the International Consortium of Investigative Journalists and a team of more than 80 journalists from 26 countries.

Big companies can book big tax savings by creating complicated accounting and legal structures that move profits to low-tax Luxembourg from higher-tax countries where they’re headquartered or do lots of business. In some instances, the leaked records indicate, companies have enjoyed effective tax rates of less than 1 percent on the profits they’ve shuffled into Luxembourg.

The leaked documents reviewed by ICIJ journalists include hundreds of private tax rulings – sometimes known as “comfort letters” – that Luxembourg provides to corporations seeking favorable tax treatment.

The European Union and Luxembourg have been fighting for months over Luxembourg’s reluctance to turn over information about its tax rulings to the EU, which is investigating whether the country’s tax deals with Amazon and Fiat Finance violate European law. Luxembourg officials have supplied some information to the EU but have refused, EU officials say, to provide a larger set of documents relating to its tax rulings.

Today ICIJ and its media partners are releasing a large cache of Luxembourg tax rulings – 548 comfort letters issued from 2002 to 2010 – and reporting on their contents in stories that will be published or broadcast in dozens of countries. It’s unclear whether any of these documents are among those still being sought by EU investigators, but they are the kinds of documents that go to the heart of the EU’s investigation into Luxembourg’s tax rulings.

The leaked documents reviewed by ICIJ involve deals negotiated by PricewaterhouseCoopers, one of the world’s largest accounting firms, on behalf of hundreds of corporate clients. To qualify the companies for tax relief, the records show, PwC tax advisers helped come up with financial strategies that feature loans among sister companies and other moves designed to shift profits from one part of a corporation to another to reduce or eliminate taxable income.

The records show, for example, that Memphis-based FedEx Corp. set up two Luxembourg affiliates to shuffle earnings from its Mexican, French and Brazilian operations to FedEx affiliates in Hong Kong. Profits moved from Mexico to Luxembourg largely as tax-free dividends. Luxembourg agreed to tax only one quarter of 1 percent of FedEx’s non-dividend income flowing through this arrangement – leaving the remaining 99.75 percent tax-free.

“A Luxembourg structure is a way of stripping income from whatever country it comes from,’’ said Stephen E. Shay, a professor of international taxation at Harvard Law School and a former tax official in the U.S. Treasury Department. The Grand Duchy, he said, “combines enormous flexibility to set up tax reduction schemes, along with binding tax rulings that are unique. It’s like a magical fairyland.”

FedEx declined comment on the specifics of its Luxembourg tax arrangements. Other companies seeking tax deals from Luxembourg come from private equity, real estate, banking, manufacturing, pharmaceuticals and other industries, the leaked files show. They include Accenture, Abbott Laboratories, American International Group (AIG), Amazon, Blackstone, Deutsche Bank, the Coach handbag empire, H.J. Heinz, JP Morgan Chase, Burberry, Procter & Gamble, the Carlyle Group and the Abu Dhabi Investment Authority.

For their part, Luxembourg’s officials and defenders say the landlocked nation’s system of private tax agreements is above reproach.

“No way are these sweetheart deals,” Nicolas Mackel, chief executive of Luxembourg for Finance, a quasi-governmental agency, said in an interview with ICIJ.

“The Luxembourg system of taxation is competitive – there is nothing unfair or unethical about it,” Mackel said. “If companies manage to reduce their tax bills to a very low rate, that’s a problem not of one tax system but of the interaction of many tax systems.”

Less than 1 percent

Disclosure of the leaked documents comes at a sensitive time for Luxembourg, a nation with a population of less than 550,000. Amid the EU probe of Luxembourg’s tax deals, former Luxembourg Prime Minister Jean-Claude Juncker is in his first week in office as president of the European Commission, one of the most powerful positions in the EU.

Juncker, Luxembourg’s top leader when many of the jurisdiction’s tax breaks were crafted, has promised to crack down on tax dodging in his new post, but he has also said he believes his own country’s tax regime is in “full accordance” with European law. Under Luxembourg’s system, tax advisers from PwC and other firms can present proposals for corporate structures and transactions designed to create tax savings and then get written assurance that their plan will be viewed favorably by the duchy’s Ministry of Finance.

“It’s like taking your tax plan to the government and getting it blessed ahead of time,” said Richard D. Pomp, a tax law professor at the University of Connecticut School of Law. “And most are blessed. Luxembourg has a very user-friendly tax department.”

The private deals are legal in Luxembourg but may be subject to legal challenge outside the country if tax officials in other nations view them as improper.

Luxembourg’s Ministry of Finance said in a statement that “advance tax decisions” are “well established in many EU member states, such as Germany, France, the Netherlands, the U.K. and Luxembourg” and that they don’t conflict with European law as long as “all taxpayers in a similar situation are treated equally.”

PwC said ICIJ’s reporting is based on “outdated” and “stolen” information, “the theft of which is in the hands of the relevant authorities.” It said its tax advice and assistance are “given in accordance with applicable local, European and international tax laws and agreements and is guided by a PwC Global Tax Code of Conduct.”

In its statement PwC said media do not have “a complete understanding of the structures involved.” While the company can’t comment on specific client matters, it rejects “any suggestion that there is anything improper about the firm’s work.”

ICIJ and its media partners used corporate balance sheets, regulatory filings and court records to put the leaked tax rulings in context. News organizations that have worked together on the six-month investigation include The Guardian, Süddeutsche Zeitung and NDR/WDR in Germany, the Canadian Broadcasting Corporation, Le Monde, Japan’s Asahi Shimbun, CNBC, Denmark’sPolitiken, Brazil’s Folha de S. Paulo and others.

U.S. and U.K. companies appeared more frequently in the leaked files than companies from any other country, followed by firms from Germany, Netherlands and Switzerland. Most of the rulings in the stash of documents were approved between 2008 and 2010. Some of them were first reported on in 2012 by Edouard Perrin for France 2 public television and by the BBC, but most of the PwC documents have never before been analyzed by reporters.

The files do not include tax deals sought from Luxembourg authorities through other accounting firms. And many of the documents do not include explicit figures for how much money the companies expected to shift through Luxembourg.

Experts who’ve reviewed the files for ICIJ say the documents do make it clear, though, that the companies and their advisors at PwC engaged in aggressive tax-reduction strategies, using Luxembourg in combination with other tax havens such as Gibraltar, Delaware and Ireland.

The documents show that:

- The Pepsi Bottling Group Inc., a New York-based unit of PepsiCo, used subsidiaries in Luxembourg to arrange a series of loans among sister companies that allowed the bottler to reduce its tax rate on its $1.4 billion purchase of a controlling interest in JSC Lebedyansky, Russia’s largest juice maker. At least $750 million of the money involved in the Russian deal traveled through a Luxembourg subsidiary named Tanglewood, before landing in a Pepsi subsidiary in Bermuda. Luxembourg acted as a tax-reducing conduit as the profits moved from Russia to Bermuda.

- New York-based Coach Inc. set up two Luxembourg entities to move €250 million in Hong Kong earnings in 2011, an amount it expected to approach €1 billion by 2013. One Luxembourg entity acted as an internal corporate bank, allowing much of the luxury goods maker’s Asian operating earnings to glide through a series of foreign entities in the form of interest payments on money the company loaned itself. Filings in Luxembourg showed that in 2012, the company paid €250,000 in taxes on €36.7 million in earnings channeled into Luxembourg – a rate of well under 1 percent.

- IKEA has used Luxembourg as part of a tax-savings strategy almost as complicated as the retail chain’s ready-to-assemble furniture. IKEA operates through two independent groups of companies: IKEA Group, which controls most of the 364 iconic IKEA big-box stores and Inter IKEA Group, which oversees franchise operations. Inter IKEA’s structure includes a Luxembourg holding company, a Luxembourg finance company, a Liechtenstein foundation and a Swiss finance arm. Leaked documents show IKEA’s Luxembourg operations opened the Swiss subsidiary in 2009 to outsource part of their financing operations to yet another low-tax jurisdiction, allowing the company to save taxes both in Luxembourg and in Switzerland.

- Belgium’s richest family, the billionaire de Spoelberch dynasty, obtained a private tax ruling from Luxembourg in 2008. The de Spoelberch clan, part of the country’s old nobility and close to the royal family, holds a big stake in ABInbev, the world’s biggest brewer whose labels include Budweiser, Stella Artois, Corona and Beck’s. The records indicate the de Spoelberch’s routed €2 billion through Ireland and then Luxembourg, reducing taxes with each step. The only sign of Luxembourg companies controlled by the family appears to be a small letter box at an address that lists nearly 190 other companies.

- Even the Canadian government got a private Luxembourg tax ruling. In 2008, the Public Sector Pension Investment Board, which manages pensions for all Canadian federal employees, including the Royal Canadian Mounted Police, bought real estate in Berlin. The pension board set up Luxembourg companies that helped it sidestep German land transfer taxes. A complex internal loan structure allowed the board to pay minimal taxes in Luxembourg on income from the German properties. The investment board has a Luxembourg office – a place where desks can be rented by the month and where two employees watch over $600 million in European investments.

The Canadian pension board and Inter IKEA both said their tax planning complies with all laws and regulations. The Canadian fund argues that because it has tax-exempt status in Canada, it ultimately gained “no tax advantage” by routing investments through Luxembourg. Inter IKEA said its total effective corporate income tax rate is currently around 14 percent.

Pepsi, Coach and an accountant for the de Spoelberch family’s Luxembourg holdings declined to comment on the specifics of their tax arrangements.

“This is the first time really that we’ve seen inside the workings of Luxembourg as a tax haven,” said Richard Brooks, a former U.K. tax inspector and author of the book The Great Tax Robbery, who was hired by ICIJ to help review some of the leaked documents. “The countries . . . that are losing money, they don't know about it, don’t know how it operates at all.”

Gilded Age

Last month, in the Gilded Age splendor of New York’s private Metropolitan Club, Pierre Gramegna, Luxembourg’s minister of finance, tried to woo the Wall Street crowd with some premier cru wine and a little levity. He told assembled financiers that he wanted to dispel the myth that his tiny country is nothing more than a tax haven: “Luxembourg is not an offshore place. I say it loud and clear.”

What he got back was hearty round of laughter.

In the wake of the EU’s probe of its tax practices, Luxembourg officials continue to bristle at their nation’s tax haven label. The country, a founding member of the EU, boasts of being a multi-lingual nation in the heart of Europe with a business-friendly and stable government. Once primarily a steel-maker and manufacturer, Luxembourg has transitioned into a financial center rivaling London, New York or Hong Kong. With $3.7 trillion in assets under management by banks and other institutions, Luxembourg is second only to the U.S. as a global investment center.

More than 170 of the Fortune 500 companies have a Luxembourg branch, according to Citizens for Tax Justice, a nonprofit research and advocacy group. A total of $95 billion in profits from American corporations’ overseas operations flowed through Luxembourg in 2012, the most current statistics from the U.S. Bureau of Economic Analysis show. On those profits, corporations paid $1.04 billion in taxes to Luxembourg – just 1.1 percent.

Other tax havens, Ireland for example, openly advertise rock-bottom corporate tax rates of 12.5 percent. Luxembourg instead maintains a statutory tax rate of 29 percent, but the leaked files show that the duchy has routinely approved tax rulings that whittle down what counts as taxable income to practically nothing. This can drop Luxembourg’s effective tax rate deep into single digits.

PwC sells Luxembourg as a place with “flexible and welcoming authorities” who are “easily contactable” and offer a “quick decision-making process”

Less than 30 percent of the tax deals in the leaked documents include a specific figure for the amount of money that companies said they planned to “invest” through the Luxembourg agreements. The total for those deals was roughly $215 billion between 2002 and 2010. The figure would likely grow to several hundred billion dollars if projected investments in other deals in the leaked PwC documents were included. And the overall figure for money shuffled through Luxembourg as the result of confidential tax agreements would grow even larger if tax deals arranged through other accounting firms were included.

PwC’s letters seeking special tax rulings were usually 20 to 100 pages long. They detail various financial strategies and then specify the tax treatment the accountants expect to get for their clients – suggesting, for example, that dividends be treated as tax-free interest.

The leaked tax rulings indicate that negotiations were conducted in private meetings between PwC accountants and Luxembourg tax officials. PwC’s written proposals were often approved the same day they were submitted.

The deals can be so complex that PwC accountants frequently include “before” and “after” diagrams to illustrate how money flows from subsidiary to subsidiary and across different countries and tax havens. The leaked records show that Luxembourg’s 2009 tax deal for Illinois-based Abbott Laboratories – which makes arthritis drugs and Ensure meal replacement shakes –features 79 steps including companies in Cyprus and Gibraltar. Abbott projected it would invest as much as $50 billion via Luxembourg.

A spokesperson for Abbott declined comment.

In a 2009 presentation, PwC highlights Luxembourg as a place with “flexible and welcoming authorities” who are “easily contactable” and offer a “readiness for dialogue and quick decision-making process.”

Most of the leaked tax rulings were approved and signed by the same tax official, Marius Kohl, now retired. Sometimes known in tax circles as “Monsieur Ruling,” Kohl was described by one Belgian newspaper as “the guardian of the only door through which companies can enter the fiscal paradise of Luxembourg.” During his time as head of a Luxembourg agency called Sociétés 6, Kohl oversaw the approval of thousands of tax agreements, personally signing as many as 39 in the course of a single day. The Wall Street Journal has reported that since Kohl retired in 2013, it can take up to six months for a tax ruling to be approved.

A woman who answered the phone at Kohl’s home told an ICIJ reporter that he wasn’t interested in talking. In a recent interview with The Wall Street Journal, Kohl said: “The work I did definitely benefited the country, though maybe not in terms of reputation.”

When a Journal reporter asked whether the prices that companies’ Luxembourg affiliates charged sister companies outside the country for the use of intellectual property and other services were accurate, Kohl licked his thumb and held it in the air.

“There was no way to verify it,” he said.

Financial Power

Luxembourg’s economy benefits from a growing cadre of lawyers, accountants, and financiers who are hired to appear before the tax authorities. PwC, for example, said in 2013 that it had more than 2,300 employees in Luxembourg and that it expected to add another 600 in 2014.

Sprawling office parks of high-rise towers, not unlike those outside of Dallas or in northern Virginia, bustle with energy. Construction cranes dot the skyline. The International Monetary Fund reports that Luxembourg has the planet’s highest economic output per capita – $112,473 per person in 2013, more than double the United States ($53,001), France ($44,099) and the United Kingdom ($39,372).

“Luxembourg is not what people think it is when you think of a tax haven,’’ Mackel, CEO of Luxembourg for Finance, said. “We make steel and car components and have a logistics industry. Our financial center is diverse with first class funds, insurance, corporate finance and Europe’s leading stock exchange. Luxembourg is about much more than this one issue they try to make of it.’’

Still, Luxembourg has many ways to cut tax bills not always seen elsewhere. For example, some 80 percent of royalties on earnings from intellectual property – software copyrights, patents and trademarks, for instance – are exempt from taxes.

Corporations that have established toeholds in Luxembourg have made use of financial instruments that shift money around the map to play one country’s tax rules against another. This might be, for instance, a hybrid debt instrument that allows profits to move out of a high-tax EU country to a Luxembourg entity. The profits are treated as interest payments in Luxembourg, where they can be deducted from taxes. In the parent company's country, they can be treated as dividends and eligible for a tax exemption.

The EU recently banned the use of hybrid loans that exploit tax mismatches between country tax systems for companies headquartered in Europe. Luxembourg and other EU members have until the end of 2015 to enact the ban into law within their own borders.

As in many tax havens, a Luxembourg office can be just a mailbox. Office buildings throughout the city are filled with brand-name corporate nameplates and little else. Some have offices and no visible employees. One building at 5 Rue Guillaume Kroll is home to more than 1,600 companies; another at 2 Avenue Charles de Gaulle houses roughly 1,450; and a building at 46A Avenue J.F. Kennedy is home to at least 1,300, according to an ICIJ analysis of Luxembourg’s corporate registry.

These companies can represent big bucks. From the U.S. alone, direct investment into Luxembourg in 2013 was $416 billion, according to the U.S. Bureau of Economic Analysis. Of that, the vast majority, $343 billion, was in the form of holding companies, which are vehicles to hold securities and financial assets rather than to create local jobs. In fact, Luxembourg represents a tiny fraction of 1 percent – 0.13 percent in 2010 – of all overseas jobs with American companies, indicating it is a place that houses money more than it provides employment.

In 2011 Luxembourg passed new rules requiring that Luxembourg-based companies that serve as internal banks for larger corporate structures station a majority of their managers and board members in the Grand Duchy. It’s unclear how these rules are enforced and the Ministry of Finance did not respond to ICIJ’s questions about mailbox companies in Luxembourg.

EU probe

Luxembourg’s freewheeling ways are gaining it few friends in nearby Brussels, the EU’s headquarters.

The European Commission, the administrative arm of the EU, is investigating whether Luxembourg’s tax rulings for Amazon and Fiat Finance constitute illegal state aid, violating rules that bar EU members from offering deals to one company that are not available to all.

“In the current context of tight public budgets, it is particularly important that large multinationals pay their fair share of taxes,” Joaquín Almunia, the commission’s vice president for competition policy until last week, said earlier this year in announcing EU probes into tax practices in Ireland, The Netherlands and Luxembourg.

Reuters reported in 2012 that Amazon’s Luxembourg arrangements allowed it to have an average tax rate of 5.3 percent on overseas income from 2007 to 2011. Amazon company filings show that in 2013 the on-line merchant reported revenues of $20 billion from its European operations, which are channeled primarily through Luxembourg.

The commission’s Amazon probe focuses on one of the online retailer’s key companies in Luxembourg, Amazon EU S.à.r.l., which handles services to Amazon’s European customers.

The commission argues that a generous 2003 tax ruling by Luxembourg authorities allows Amazon EU S.à.r.l. to funnel millions of euros in tax-deductible royalties each year to yet another Amazon company in Luxembourg, a limited partnership that is tax exempted. This tax break and others like it allow Amazon to pay little in taxes in the Grand Duchy on its European sales.

The leaked PwC documents show that in 2009 Amazon EU S.à.r.l. reported more than €519 million in royalty expenses while the limited partnership Amazon Europe Holding Technologies SCS had an influx of the same amount “based on agreements with affiliated companies.” Thanks to the royalty expenses and other deductions, Amazon EU S.à.r.l. posted a taxable profit of just €14.8 million and paid €4.1 million in taxes in Luxembourg.

A spokesman for Amazon said the company “has received no special tax treatment from Luxembourg—we are subject to the same tax laws as other companies operating here.”

As EU authorities are pushing their corporate tax probes, a leading multinational group, the Organization for Economic Cooperation and Development, has proposed a new set of rules that would bar companies from using many common practices to shift profits into tax havens. Approval of the OECD’s proposals, however, is uncertain and years away.

Gramegna, Luxembourg’s finance minister, said in an interview with ICIJ in New York that “the European Commission is entitled, by treaty, to look after fair competition and at state aid. They decided to look into Amazon. We are telling the European Commission that everything we’ve done has been within the general principles of the European Union and the OECD.”

Adding a political twist to the Brussels probes is Juncker’s rise to the presidency of the European Commission. As Luxembourg’s prime minister, he signed into law the provision that allows companies to write off 80 percent of royalty income from intellectual property.

In a speech in July in Brussels, Juncker promised to “fight tax evasion and tax dumping. … We will try to put some morality, some ethics, into the European tax landscape.” But he also recently told German television: “No one has ever been able to make a convincing and thorough case to me that Luxembourg is a tax haven. Luxembourg employs tax rules that are in full accordance with European law.”

At a press conference two weeks ago, Juncker promised he wouldn’t try to influence regulatory cases involving Luxembourg: “I won't abuse my position in order to pressure commissioners to make different decisions regarding Luxembourg than they would regarding similar cases.”

Many observers are skeptical Luxembourg and its allies will give up the country’s flexible tax regime without a battle.

Jürgen Kentenich, chief tax fraud investigator in the German city of Trier, which lies near the border with Luxembourg, worries that big companies and their accountants will keep finding ways to take advantage of the deals offered by Luxembourg and other financial havens, while smaller companies and average taxpayers are left to make up the what’s lost in tax revenues.

“It’s always the same story,” he said in an interview with ICIJ’s partner, the Canadian Broadcasting Corporation. Accounting firms are always coming up with fresh ways to cut tax bills “and lawmakers and tax authorities are always behind, always chasing.”

http://www.icij.org/project/luxembourg-leaks/leaked-documents-expose-global-companies-secret-tax-deals-luxembourg

Secret Tax deals including Double Taxation Avoidance Treaties with countries like India

http://www.icij.org/project/luxembourg-leaks/leaked-documents-expose-global-companies-secret-tax-deals-luxembourg