http://www.admin.ch/opc/en/classified-compilation/20100418/201102010000/196.1.pdf Federal Act

on the Restitution of Assets illicitly obtained by Politically Exposed Persons Restitution of Illicit Assets Act (RIAA) of 1 October 2010 (Status as of 1 February 2011)

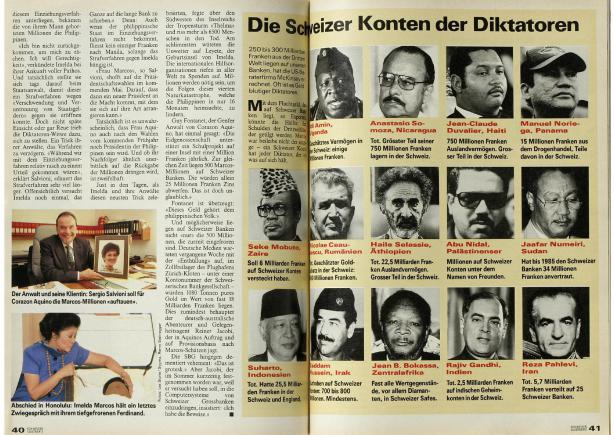

Start with return of Rajiv Gandhi account monies (reported by Schweizer Illustriete) to Indian financial system. NaMo government should enact an ordinance nationalising such illicit wealth held abroad the way Indira Gandhi nationalised private banks.

Kalyanaraman

Swiss Bank Secrecy Ends

The News Minute| Bangalore, Geneva| May 6, 2014| 10.10 pm IST

The Swiss banking secrecy laws, cherished and envied by one and all ended today as Switzerland signed on to an Organisation for Economic Co-operation and Development (OECD) pledge with 47 other countries with which it will be obliged to exchange a series of information.

“It is clearly the end of banking secrecy abused for tax purposes,” said OECD tax Director Pascal. Switzerland and Singapore on Tuesday joined the growing ranks of countries agreeing to share tax information automatically between governments.

An influential Swiss money manager told The News Minute (TNM) under the pledge signed by a total 47 countries, all financial information will be shared between governments, including taxpayers' bank balance, dividends, interest income and sales proceeds used to calculate capital gains tax. While secrecy ends, foreigners with bank accounts in the country will be able to conduct normal and transparent businesses.

"It's clearly the end of bank secrecy abused for tax purposes," OECD tax director Pascal Saint-Amans told journalists at a meeting held by the international think tank in Paris. "It means that governments can really assess the tax owed by people who thought they could hide in other jurisdictions," he added.

The agreement with the OECD will also mean that all countries including India will now be able to automatically receive information about illegal activities in Swiss banks by tax evaders and money launderers.

While most of the signatories had already committed to sharing tax information on an automatic basis, the fact that Switzerland and Singapore have now also signed up is a big step in a fight against tax evasion that governments have intensified since the global financial crisis.

With agencies

Facing mounting pressure to dismantle a cherished culture of banking secrecy, some of Switzerland's 300-plus private banks had already signalled last year their readiness to work with U.S. officials to crack down on wealthy Americans.

http://www.thenewsminute.com/stories/Swiss%20Bank%20Secrecy%20Ends#.U2m44IGSySp