GST, by other means

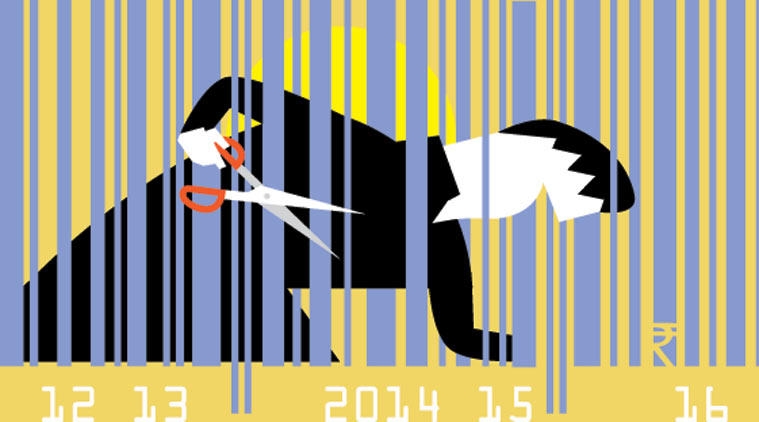

There are questions about the feasibility of introducing the tax by April 2016. (Illustration: C R Sasikumar)

There are questions about the feasibility of introducing the tax by April 2016. (Illustration: C R Sasikumar)The initiative to reform the multiple production and consumption taxes at the Union and state levels into a dual goods and services tax (GST) has run into rough weather once again. The reform has been on the agenda for a considerable period of time. Several deadlines were announced and missed. With the Constitution (122nd Amendment) Bill not getting passed in Parliament, this seems to be yet another case of the missed deadline.

The experience on the GST reform throws up three important concerns. First, in a major reform involving the Union government, 29 states and two Union territories with legislatures, it would be unrealistic to expect a “flawless” GST. The modified bill has shortcomings, both in its coverage and in the retention of the tax on inter-state transactions. This is only the beginning of a series of compromises that may have to be made when the issue of structure and operational details are discussed in the GST Council. Second, the extent of productivity gains will depend on the structure that will ultimately be adopted. Optimistic projections about its gains, particularly in relation to growth, without knowing the structure of the tax, could lead to disappointments later. Finally, it is highly unlikely that the reform can be operationalised by April 2016. Besides passing the bill in Parliament and getting half the states to ratify it, there are a number of issues on which the GST Council will have to take decisions. Going by past experience, this is not likely to be smooth.

The interesting question is, can the Union government, by itself, transform its domestic indirect taxes into a GST at the manufacturing stage by April 2016, without having to amend the Constitution? This could also provide a clear roadmap for making a full-fledged transition to the GST as and when the constitutional hurdle is cleared. Further, it can be a major motivator for states to move on the reform path.

The GST is an important reform for improving competitiveness in Indian manufacturing. However, the extent of productivity gains will depend on the structure and operational details of the levy that will eventually emerge. There are some shortcomings in the present bill and the most important of these relates to the 1 per cent tax on inter-state transactions. In fact, this goes against the GST’s fundamental principle of making the tax destination-based and ensuring seamless transactions across the country. The exclusion of motor spirit and high-speed diesel will add to the cascading. With almost 30-35 per cent of sales tax being collected from motor spirit and high-speed diesel, states are hesitant. One solution is to include them in the GST, but have a separate excise tax or carbon tax. Similarly, in the case of alcoholic products, the international experience is to include them in the GST and have a separate “sin” tax on them.

The bill provides only a minimalist framework and leaves the structure and operational details to the GST Council. This implies that the entire gamut of issues relating to the structure and operation of the levy has to be negotiated and decided on by the council. These include the taxes to be subsumed, the list of goods and services to be exempted, thresholds for Central GST and state GST, structure of rates, place of supply rules, arrangements for special category states, harmonised tax laws and the date of including the tax on petroleum products, alcohol and tobacco products, operational details of the tax administration, including the GST network, and dates for discontinuing the tax on inter-state sale of goods and services. In each case, the interests of the negotiating parties are not always similar. Decisions have to be taken by voting in the council. With the Union government having two-thirds of the vote, no decision can be carried without its approval, even if it is desired by all the state governments. The important issue is, the GST that will eventually emerge out of compromises will have a number of infirmities.

There has been considerable debate on the structure of rates for the proposed GST. The bill has left the issue to be settled by the GST Council. The council will have to consider the revenue-neutral rate of tax estimated by an expert body. Gains to the economy will depend on having a broad base and low rate. When two rates are levied for Central and state GST, the standard rate is bound to be higher than when a single rate is applied. Whatever is the rate structure recommended by the committee under the chief economic advisor, the Empowered Committee of State Finance Ministers will have to take a final call. It would be inappropriate to fix the maximum rate in the Constitution because this is an executive decision. However, while taking a decision in the council, the Union government may agree to have the standard rate at 10 per cent for both Central and state GST, even if the revenue-neutral estimate is higher, which means the Centre will have to compensate for any shortfall in revenue collection. Since most revenue-neutral estimates do not take into account improvement in compliance, this is a calculated risk the government will have to take. Furthermore, linking GST registration numbers with the income tax PAN in the GST network could substantially increase revenue collection from income tax.

There are questions about the feasibility of introducing the tax by April 2016. Given the number of hurdles, the Centre can partially fulfil its promise of introducing the GST by transforming its own domestic indirect taxes into the GST at the manufacturing stage. This can be achieved by working out a common threshold for excise duty and service tax, rationalising the excise duty by making all rates ad valorem, converging and unifying the rates into two — one for items of common consumption and the other, a standard rate to be applied to all remaining goods and services — and providing input tax credit for goods against services and vice versa. Even at present, the tax credit mechanism exists for goods and services. Rationalisation along these lines will substantially simplify the system and transform the Central indirect taxes into a GST at the manufacturing stage. This, in fact, was the recommendation of the expert group on the taxation of services in 2001 and can be accomplished without going through a constitutional amendment. Even as introducing a full-fledged GST is likely to take time, this reform will help in its eventual introduction. This can be accomplished by April 2016 and the finance minister can legitimately claim that, under the constraints placed on him, he has brought about reform in Central indirect taxes.

Transforming the prevailing domestic indirect taxes into a destination-based GST is surely an important reform. In the given political environment, however, it may be better to approach the reform as a process and not an event.

Rangarajan is former chairman of the Economic Advisory Council to the Prime Minister and former governor, RBI. Rao was member, Fourteenth Finance Commission and is emeritus professor, NIPFP.http://indianexpress.com/article/opinion/columns/gst-by-other-means/