NaMo's promise made to Bharatiya is to ensure restitution of illicit wealth. DO IT. Nationalise kaalaadhan.

While the IT route of Finance Bill is fine, there is a lot more to be done under the existing littany of laws.

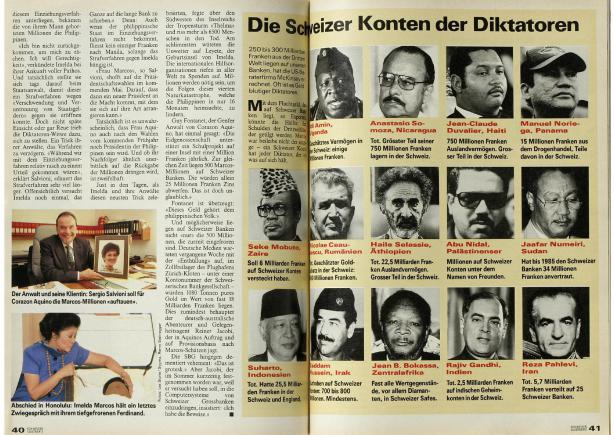

For example, enforcement of Prevention of Money Laundering Act, enforcement of Know Your Client principles of financial propriety by financial institutions. There is a well-recognized category under International Law called Politically Exposed Persons (PEPs) and defined precisely in UN Conventions against Corruption, Drug Trafficking and Terror Financing. Financial institutions should alert law enforcement agencies on apparently illicit transborder financial transactions of the type reported by Schweizer Illustriete about Rajiv Gandhi's Swiss Bank Account. Has Enforcement Directorate taken action against this KYC disclosure of great importance?

There is a law in Switzerland for Restitution of Illicit Wealth of PEPs. All this restitution needs is a parliamentary resolution asking for restitution of the identified wealth. NO NEW LAW IS NEEDED. So, the question to ask of the proposed Finance Black Money Bill is this: Will it get back Rajiv Gandhi account wealth in Swiss Account?

http://www.admin.ch/opc/en/classified-compilation/20100418/201102010000/196.1.pdf Federal Act

on the Restitution of Assets illicitly obtained by Politically Exposed Persons Restitution of Illicit Assets Act (RIAA) of 1 October 2010 (Status as of 1 February 2011).

Who is a PEP? In financial regulation, "politically exposed person" (PEP) is a term describing someone who has been entrusted with a prominent public function, or a relative or known associate of that person. A PEP generally presents a higher risk for potential involvement in bribery and corruption by virtue of their position and the influence that they may hold.

Start with return of Rajiv Gandhi account monies (reported by Schweizer Illustriete) to Indian financial system. NaMo government should enact an ordinance nationalising such illicit wealth held abroad the way Indira Gandhi nationalised private banks.

If the NaMo government is serious about restitution of illicit wealth, Parliament (Lok Sabha) should declare kaalaadhan nationalised, the way Indira Gandhi nationalised private banks and declared herself to be a revolutionary.

So, NaMo, identify PEPs and enforce the existing littany of laws to recover kaalaadhan. The proposed finance bill is fine but will be for future enforcement by asking for all citizens to submit IT returns of financial accounts held abroad, whether the income is taxable or NOT. This is fine to catch the possible culprits who may be inclined to accumulate kaalaadhan outside the nation's financial system.

Also, issue a declaration that RBI will be instructed to facilitate opening of Foreign Currency accounts in India's financial institutions for RESIDENT INDIANS. The objective is simple: keep the money in any currency for the benefit of the nation, by keeping the money in the Indian financial system and prevent foreign financial institutions from benefiting from the loot.

Remember, the post-colonial loot is larger than the colonial loot. Get it back, NaMo. The nation will bless you and you will be remembered as Kautilya or Chanakya of Swarajya Bharatam.

S. Kalyanaraman

Sarasvati Research Centre.

Black Money Bill to be tabled in Lok Sabha on Friday

New Delhi, Mar 19:

The government is expected to bring in a comprehensive new legislation on black money in Parliament on Friday, to tackle money stashed away abroad.

The proposed Bill, titled the Undisclosed Foreign Income and Assets (Imposition of New Tax) Bill, 2015, will have provision for imprisonment up to 10 years for concealing a foreign account, tax at the rate of 30 per cent along with penalty at the rate of 300 per cent of tax dues, no compounding and no settlement etc. It will also provide for a small window for those holding overseas assets to declare their wealth, pay taxes and penalties to escape punitive action. Once introduced, the Bill is likely to be sent to the departmentally-related Standing Committee.

The Bill also proposes to make concealment of income and evasion of tax in relation to a foreign asset a ‘predicate offence’ under the Prevention of Money Laundering Act (PMLA) , which will enable the enforcement agencies to attach and confiscate the accounted assets held abroad and launch proceedings. It also seeks to make non-filing of income-tax returns or filing of returns with inadequate disclosure of foreign assets liable for prosecution, with punishment of rigorous imprisonment of up to 7 years.

The proposal to come out with a new law on black money was announced by Finance Minister Arun Jaitley in his Budget speech last month. The issue of black money, especially stashing of illicit wealth abroad in places, such as Switzerland, has been a matter of debate for a long time. In fact, this was a major issue for the ruling BJP during its election campaign when it promised to work toward curbing such illicit money.

The new legislation has been conceptualised keeping this in mind. Once enacted, it will be mandatory for the beneficial owner or beneficiary of foreign assets to file returns, even if there is no taxable income. The date of opening of foreign account will be mandatorily required to be specified by the assessee in the income returns. The definition of ‘proceeds of crime’ under PMLA is also being amended to enable attachment and confiscation of equivalent assets in India where the assets located abroad cannot be forfeited.

http://www.thehindubusinessline.com/news/black-money-bill-to-be-tabled-in-lok-sabha-today/article7011232.ece?homepage=true&theme=true