Is this the way to energise civil servants?

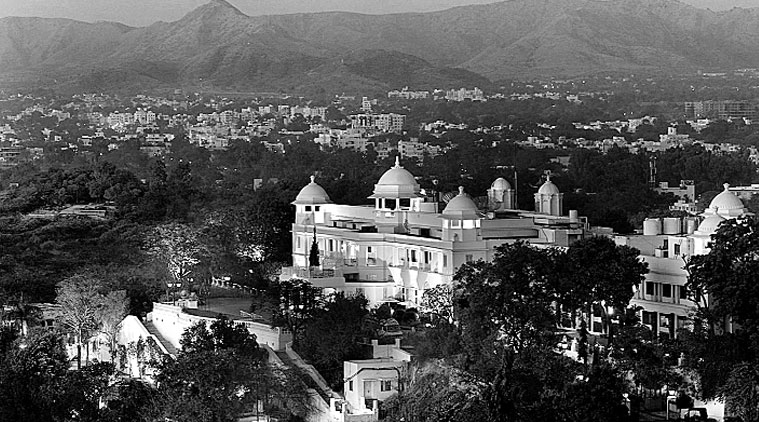

![The renovated Laxmi Vilas hotel, which, at the time of divestment in 2002, was spending Rs 3 crore to earn Rs 2 crore annually.]() The renovated Laxmi Vilas hotel, which, at the time of divestment in 2002, was spending Rs 3 crore to earn Rs 2 crore annually.

The renovated Laxmi Vilas hotel, which, at the time of divestment in 2002, was spending Rs 3 crore to earn Rs 2 crore annually.

http://indianexpress.com/article/opinion/columns/is-this-the-way-to-energise-civil-servants/

The renovated Laxmi Vilas hotel, which, at the time of divestment in 2002, was spending Rs 3 crore to earn Rs 2 crore annually.

The renovated Laxmi Vilas hotel, which, at the time of divestment in 2002, was spending Rs 3 crore to earn Rs 2 crore annually.Written by Arun Shourie | September 5, 2014 8:04 am

CBI move to investigate the disinvestment of Udaipur’s Laxmi Vilas hotel on the basis of an anonymous oral complaint, 12 years after the decision, holds a lesson for those who are trying to get the bureaucracy going.

Hindustan Zinc was privatised in April 2002. The privatisation was challenged on various grounds in the Supreme Court. In December 2012, after hearing counsel, the SC rejected the challenge.

That did not deter the CBI. In February 2014 — TWELVE years after the disinvestment, and with HARDLY A YEAR having passed since the SC delivered its judgment — the CBI launched a new “investigation” into the disinvestment.

When its officers came to me, I asked them about the complaint on the basis of which they had commenced the investigation. They said that there had been nothing in writing, just an oral complaint!

The same pattern has now been repeated in the case of the disinvestment of Laxmi Vilas Hotel in Udaipur. The hotel was disposed of in 2002. Of the ITDC’s 20-odd hotels, this one had distinguished itself by incurring the highest loss: to earn gross revenue of Rs 2 crore a year, the hotel spent Rs 3 crore — a loss of 51 per cent. The occupancy rate of the hotel had fallen to 26 per cent. Far from being a luxury palace, the place was in shambles — the plant and machinery were defunct, the furniture, etc were in the sorriest state that you can imagine. This will be evident from two elementary facts. ELEVEN parties expressed an initial interest in bidding for the hotel. FIVE of them carried out thorough due diligence. Such was the condition of the property that four of the five dropped out. I am informed that Bharat Hotels — the winning bidder — had to spend Rs 25 to 30 crore on renovating the place and getting its plant and machinery in working order. Furthermore, the quality of the staff was such that Bharat Hotels had to spend another Rs 3 to 5 crore on voluntary retirement schemes.

TWELVE years after the disinvestment, the CBI has registered an FIR — naming, among others, the then secretary of the disinvestment ministry and accusing him, among other things, of “dishonestly and fraudulently and with mala fide intention” doing this, that and the other. On what basis? The FIR itself states that it has been registered on the basis of “an anonymous complaint”. I will come in a moment to the utter indefensibles that mar the FIR, but the first point to consider is: Should any agency have the authority to harass civil servants for decisions taken 12 years ago? Should it have the power to ruin the reputation of civil servants and to put them to endless trouble 10 years after they have retired? Should it have the power to ruin people’s reputations on the basis of “anonymous complaints” and “oral complaints”?

One of the main objectives of the prime minister, and key to the other objectives he has in mind, is to energise the bureaucracy. Which is the civil servant who will take decisions, who will accept responsibility, who will stick his neck out, if 12 years from now, 10 years after he has retired, when he has no access to lawyers or records, he is going to be hauled up by sundry inspectors and SPs of the CBI?

Courts of no consequence

Nor does the parallel with Hindustan Zinc end there. That privatisation had been challenged and the challenge was rejected by the SC. The privatisation of this hotel too was challenged — and that challenge too was rejected, this time by the Rajasthan High Court. And the central ground on which the privatisation was challenged, and the ground that was decisively rejected by the high court, is the very ground on which the FIR focuses — a ground to which I shall revert in a moment. But first, the question that arises from that simple fact of rejection by the courts: when a high court has upheld a sequence of decisions, when the SC itself has done so, should an agency such as the CBI be able to open the matter yet again and start harassing officers and others?

And to open it TWELVE years after a decision has been taken? Shouldn’t there be a period of limitation?

Ruined reputations

Nor is it just a matter of harassment, though that is bad enough. No one who has not been put through the mill can imagine the strain and distress to which the person and his family are subjected by such inquisitions and “raids”. What about the irreparable damage to the person’s reputation? What bunkum did the CBI not put out just the other day about two distinguished civil servants, C.B. Bhave and P.C. Parakh? And what has it said now, while closing the cases against them? Should the CBI not be made to pay for the calumny it had hurled?

But I do feel that in this regard others also are at fault — the press, civil servants as a group and even the victims.

Has the CBI not somersaulted a sufficient number of times for the press to realise that it must not swallow and propagate what such agencies put out?

And the civil servants — haven’t they seen a sufficient number of times how they have themselves behaved in the wake of investigations against their colleagues? The moment the CBI says it has commenced an inquiry against X, his erstwhile colleagues treat him as a leper. Till yesterday, he was your colleague and friend, and now you avoid him. Shame on such colleagues and friends! That is no way to be: on the contrary, we must be fortresses around the honest, and all the more so around one who has been a colleague and friend, and of whose competence and integrity we have had personal knowledge.

And the victims — they are so easily felled, most of all by the apprehension that their reputation has been ruined. Such agencies and their concocted FIRs can ruin our reputation. Being calumnised by the dishonest is actually a badge of honour! I address audiences once a week or so. On these occasions, as is custom, the hosts use superlatives to introduce me — the positions I have held, the awards that have been given me, the books I have written… When my turn comes, I always say, “But the organisers have left out my two main distinctions. First, I am the only editor who has been dismissed from his job, not once but twice. Second, I have what none of you have — I am the only one here who has three certificates of honesty from the CBI.” So: thicker skins and a little contempt for the calumners!

The hotel

And now a few points about the hotel that is the subject of the new FIR.

The CBI has put out that the actual value of the property was Rs 151 crore, and government sold it for Rs 7.5 crore.

To substantiate that Rs 151 crore figure, the CBI says that the Rajasthan government itself had asked Bharat Hotels — the company that won the bid — to pay Rs 15 crore as stamp duty. True to character, the CBI conceals the fact that this demand, made by the local officer, has been stayed by the courts!

Next, it says that the hotel has 29 acres of land. It conceals the fact that this land, being adjacent to the lake, falls within the Coastal Regulation Zone and that nothing can be built on it. I am told that Bharat Hotels sought permission to add some rooms. And that the municipality refused permission on the ground that the land falls within the Coastal Regulation Zone. I am told that a case is currently before the SC against establishments that have constructed or added to structures along the lakeshore. Bharat Hotels has NOT been arraigned in the case.

But assume for a moment that, in spite of the regulations and in spite of the refusal of permission by the municipality, Bharat Hotels has built additional accommodation.

In that case, Bharat Hotels and the persons with whose connivance it has built the additional accommodation should be arraigned — not the disinvestment process and those who were associated with it.

Moreover, such absurd figures were the gravamen of the grounds on which the disinvestment was challenged. While rejecting them, the court rightly pointed out that a buyer does not buy assets in the abstract. He buys them for their business potential, that in the instant case he was buying not assets but shares of a company considering their earning potential.

There is another telling point. I am not sure if the CBI investigators remember that 10 per cent of the shares of the ITDC, the government company that owned the hotel, were owned by none other than the Indian Hotels Company of the Tata Group. It was compensated for its equity at exactly the same rate that the government got from the disinvestment. Had the property been worth Rs 151 crore, would the Tata Group — a private company, answerable to its shareholders — have accepted Rs 70 lakh (10 per cent of the value for which the hotel was sold) and thereby sacrificed Rs 15 crore (the 10 per cent share that would have accrued to them if the value of the hotel had been Rs 151 crore)?

Contrary to what the CBI has insinuated, the asset valuer was jointly chosen by the financial advisors (Lazard) and the ITDC from among the list of government-approved valuers. Five or more valuers from the government-approved list were invited to make presentations. Their qualifications and experience were jointly examined, and then alone was the particular firm chosen for the task.

That care marked every other step also. As in every case of disinvestment, every single one of the prescribed procedures was meticulously followed. Every step of the process, including the setting of the reserve price and the acceptance of the final bid price, was taken with the explicit approval of the Cabinet Committee on Disinvestment. In particular, the shareholders agreement was cleared by the law ministry thrice over — at the draft stage, at the stage when it was frozen and finally when the bids were to be accepted. The then law minister is the one link between that cabinet committee and the present government: he was law minister then and a member of the Cabinet Committee on Disinvestment, and is in-charge of the disinvestment department in the present government. He has stated in an interview that he is well acquainted with every aspect of the disinvestment and that everything about the transaction was in order.

Telling figures

A young analyst, well acquainted with valuations, draws my attention to a series of facts that show how way off the CBI’s imaginative figure of Rs 151 crore is. I will list just a few of them.

* Laxmi Vilas Palace was one of the 20-odd properties owned by the ITDC and amongst the smallest. Further, of its properties, it was the one that was making the highest losses.

* Between 1996 and 2001, the occupancy of Laxmi Vilas Palace came down from 41 per cent to 26 per cent and the hotel faced heavy losses.

Note that the overall occupancy in Udaipur was still 41 per cent in 2002.

* Given the abysmal performance, the net profit margin reduced from 34 per cent to a loss of 51 per cent; to earn gross revenue of Rs 2 crore, the hotel spent Rs 3 crore! At the time, the average hotel in India made Rs 4.5 crore in revenue and Rs 1 crore of net profit (assuming a 25 per cent margin).

* A valuation of Rs 151 crore for the property, as suggested by the CBI, would imply a valuation of over Rs 3,000 crore for the 20-odd ITDC hotels in 2001-02. Compare this figure with the valuation of the Tata Group’s Indian Hotels (one of the most efficient private operators, which owns the Taj Group of hotels and had at that time 65 properties with around 8,100 rooms). This latter chain had an equity valuation of barely Rs 800 crore in 2002.

* The full enterprise value of the Taj Group in 2002 was Rs 2,400 crore for the 65 hotels it owned; each Taj hotel had an average of 125 rooms. At that valuation, each Taj property was being valued at Rs 36 crore. Laxmi Vilas was and is a 55-room hotel; so, even on Taj benchmarks of valuation per room, it would be worth Rs 15 crore! At the Rs 3 crore a room that is implied in the CBI’s figure, Indian Hotels (with a portfolio of around 8,100 rooms) should have been worth Rs 24,000 crore in 2002 itself; that is, more than twice what the company is worth in 2014!

Other comparables also highlight the imaginativeness of the Rs 151 crore valuation:

* HVS are one of the leading consultants and valuation experts in the hotel space globally. They do a detailed assessment of hotel values by city. While they did not do a study for Udaipur, they did one for Jaipur. Their estimate for a hotel in Jaipur in 2002 was Rs 12 lakh per room for a medium-class hotel and Rs 30 lakh per room for a luxury property. Similarly, their range for Agra was Rs 9 lakh to Rs 12 lakh per room.

Udaipur was not part of the golden triangle and had lower occupancy rates and far lower rentals in comparison with both Agra and Jaipur. Based on their assessment and an average rate of Rs 12 lakh per room (accounting for the poor profitability of Laxmi Vilas), one gets a value of Rs 6.6 crore for Laxmi Vilas. Even at the high-end valuation of Rs 30 lakh per room, one gets a value of Rs 16 crore!

* In accordance with the HVS studies, even today a luxury hotel in Jaipur would be worth Rs 77 lakh per room; that implies a value of Rs 42 crore for a 55-room property, 14 years after the disinvestment of the Udaipur hotel!

* Lands End Hotel in Mumbai was purchased by the Taj Group at Rs 80 lakh a room in 2002. This was the highest prime property sold in India in that year. However, if we go by the CBI allegation of a value of Rs 151 crore for Laxmi Vilas (a 55-room hotel), we would have to place the value at Rs 3 crore a room in Udaipur. Udaipur had an occupancy rate of 41-42 per cent over 1999-2002 and room rates of Rs 1,900, as against Rs 3,500 for Mumbai.

* In 2011, Sinclair Hotels purchased Savannah Hotels in high-end Whitefield in Bangalore for Rs 38 lakh per room. At this 2011 valuation, Laxmi Vilas would be valued at Rs 20 crore.

* In 2008, Mahindra Holidays & Resorts purchased Hotel Ooty Villa Park from PVP Ventures — a 100-room property — for Rs 33 crore (including all amenities and assets). This is in 2008 — six years after one of the fastest growing periods in terms of real-estate pricing in India.

* In 2014 (12 years after the Laxmi Vilas transaction), Royal Orchid sold its 155-room property in Hyderabad for Rs 175 crore. Even at this price of Rs 1.2 crore per room, the Laxmi Vilas property would be worth Rs 70 crore. How is the price for a five-star property in Hyderabad 12 years later still unable to justify the supposed Rs 151 crore valuation in 2002?

I can go on adding to the list. But the point will be obvious: we can be fairly certain that the CBI officials in Jodhpur would be innocent of such comparisons. There is a real problem here, and it holds a lesson. Even if one sets aside conspiracy theories, the problem is that the CBI staff, especially at the lower level, just do not understand valuation and other aspects of such transactions. I have had personal exposure to this innocence — when the CBI officials came to ask me about the disinvestment of Hindustan Zinc, for instance.

At the least, that holds one lesson for all who are today trying to get the bureaucracy going: among the reforms that are urgently required is to upgrade the domain knowledge of officials working in our investigating agencies. Otherwise, goaded by pep-talks, honest officers will take decisions on complex matters, only to be hauled up 10-12 years later by persons innocent, at least of considerations that bear on those decisions.

The writer, a former Rajya Sabha MP from the BJP, was Union minister for communications, information technology and disinvestment

http://indianexpress.com/article/opinion/columns/is-this-the-way-to-energise-civil-servants/