Brilliant expose by Supriya Sharma in two parts.

Yes, NaMO and Arun Jaitley should begin at home. both should start their efforts at restitution of illicit wealth by looking at SoniaG chamchas.

Kalyanaraman

India's land, and not Switzerland, is where the hunt for black money should begin

In popular perception, India's black money lies locked up in bank vaults in Switzerland. But experts studying the illegal economy say there is reason to believe that more unaccounted wealth remains within the country – literally parked on Indian land.

Supriya Sharma June 6, 2014

On his first day as the prime minister of India, Narendra Modi announced the formation of a high-powered Special Investigative Team to investigate black money that has been sent abroad by tax evaders.

The decision lent an aura of purposefulness to the new government.

Black money had featured prominently in the public discourse in the run-up to elections. As part of its election campaign, the Bharatiya Janata Party had promised to bring back black money stashed away abroad.

But experts say that shorn of its popular appeal, the singular focus on foreign-held funds is misplaced. These funds represent only a part of the illegal economy of India. But how large or small are they relative to the rest of the economy?

The trouble estimating the size of the foreign-held funds

There are no available official estimates for the size of the illegal economy in India. In 2011, the government had asked three institutions – National Institute of Public Finance and Policy, National Council of Applied Economic Research and National Institute of Financial Management – to study unaccounted income and wealth in India. At least one of the three institutes has submitted its final report but the ministry has not made it public.

In the absence of an official estimate, the media in India usually falls back on this report published in 2010 by a Washington-based think-tank, Global Financial Integrity.

It estimated that between 1947 and 2008, Indians had transferred $213.2 billion of illicit money abroad. If returns at the rate of short-term United States treasury bills were added, the value of the cross-border illicit transfers rose to $462 billion.

"This is a huge loss of capital which, if it were retained, could have liquidated all of India’s external debt totalling $230.6 billion at the end of 2008 and provided another half for poverty alleviation and economic development," writes Dev Kar, the economist who authored the GFI report.

Extrapolating from a study done in 1982, Kar says, "The size of India’s underground economy should be at least 50% of GDP or about $640 billion based on a GDP of $1.28 trillion in 2008. This means roughly 72.2% of the illicit assets comprising the underground economy is held abroad while illicit assets held domestically account for only 27.8% of the underground economy."

This is misleading, says Arun Kumar of the Centre for Economic Studies and Planning at Jawaharlal Nehru University. In this article in the Economic and Political Weekly, Kumar points out that Kar has compared the stock at the end of a period (illicit assets transferred over six decades) to an annual flow (the annual gross domestic product for one year). "It would have been better to present the annual flow of savings going out of India as a ratio of the annual GDP," he writes.

Taking illicit transfers as a ratio of GDP, Kar estimated that black money sent abroad on an average amounted to about 1.5%-2.2% of India’s annual GDP.

His latest report, published in December 2013, based on a different methodology, however, revises upwards the estimates of illicit outflows from India. Based on the revised estimates, the black money sent abroad comes to more than 4% of India’s GDP.

Why Mauritius is more important than Switzerland

But black money sent abroad is not the same as black money held abroad. Funds are moved out of India not to be stashed away in Swiss banks but to be brought back as foreign investment, said an official with an investigative agency who did not wish to be named. This is called "round-tripping".

In the case of India, this mostly happens through sham corporations registered in Mauritius. While the money comes back as investments, the earnings on such investments are not taxed in India because India and Mauritius have a double tax-avoidance treaty.

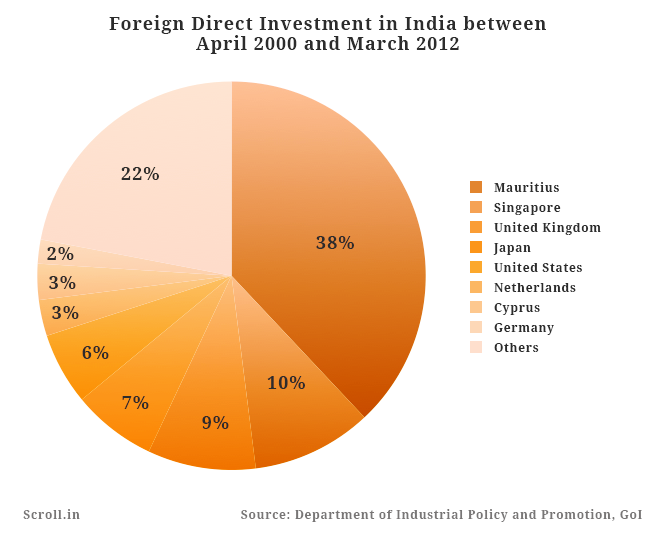

The primacy of the small island to the subcontinent is apparent from this statistic: Between 2000-2012, 38% of the foreign direct investment in India came from Mauritius, while only 6% came from the US. Mauritius accounted for $8,059 million of $18,286 million of FDI in India in 2012-'13.

If the government were serious about tackling the black economy in India, it would achieve more by closing the loopholes in the Mauritius route than by investigating Swiss bank accounts, said a government official on the condition of anonymity.

Real Estate is the big storehouse of black money

Where do the foreign funds that come into India go? A major destination is the real estate and construction sector. Between 2005 and 2010, FDI in India's real estate and housing market jumped 80 times. In 2010, nearly $5,700 million of foreign funds were invested in the sector.

The legal real estate sector accounted for nearly 11% of India’s GDP in 2011. But economists studying the black economy say the illegal real estate sector could be nearly as large, if not larger.

It is common knowledge that the sector generates black money when buyers and sellers of land keep the value of their transaction hidden from authorities to evade stamp duty. But as this ‘White Paper’ prepared by the Central Board for Direct Taxes in 2012 states, investment in property is also “a common means of parking unaccounted money".

Economists believe the infusion of black money has contributed to the sharp and sustained rise in land prices, which is making housing unaffordable for an overwhelming majority of Indians.

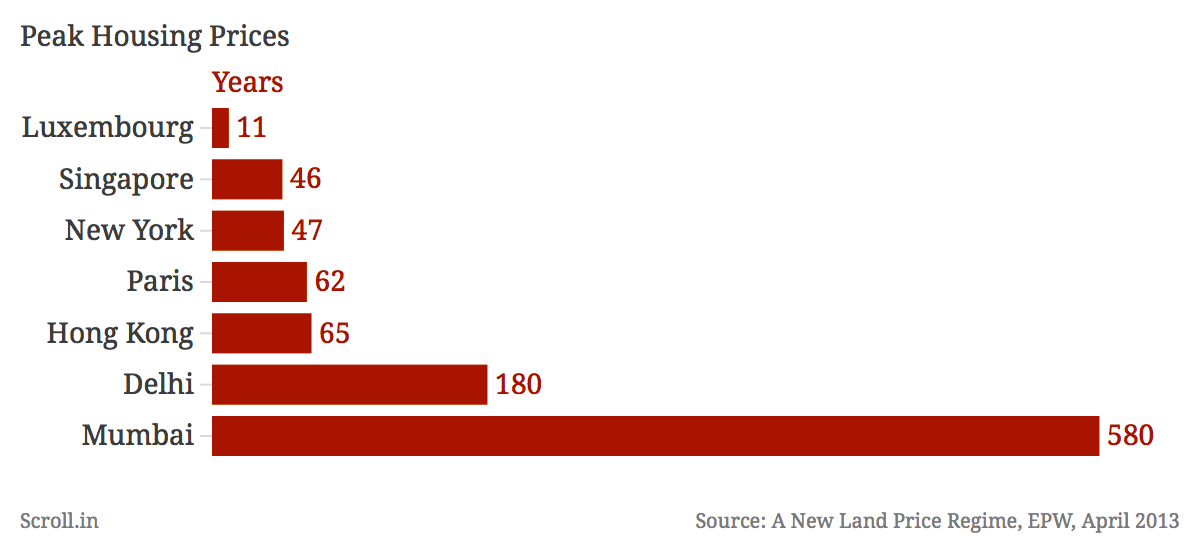

Urban land prices have risen five fold in the decade 2001-'11, writes Sanjoy Chakravorty, professor at Temple University. A citizen with an average national income would need to work for 62-67 years to buy property at the highest end of the market in Hong Kong, London, Tokyo and Paris. In contrast, it would take her 580 years to buy property at the highest end in Mumbai and 100 years to buy a modest 800 square feet flat at the metropolis-wide average rate.

In villages too, the prices of farmland have been showing puzzling spikes, as this report in the Economic Times said. It found that even villages far away from cities, highways and industrial projects were seeing inexplicably high land prices.

A CBDT report prepared in 2012 said, “Land and real estate are possibly the most important class of assets used for investment of black money.” Of the undisclosed incomes that the IT department detected in 2011-'12, the largest chunk – amounting to 40% – came from the real estate sector, PTI reported.

A private consultancy firm, Liases Foras, estimated that 30% of transactions in the property market in the first six months of 2012 went unaccounted. Speaking on the condition of anonymity, government officials said they believe the ratio is much higher – which means a larger portion of India’s GDP could be parked undisclosed in real estate deals within India than in secret bank vaults abroad.

There is another reason why cleaning up the real estate sector in India could be more fruitful than trying to bring back black money from abroad: despite signing hundreds of bilateral treaties to compel tax havens to share information on secret bank accounts, even the powerful G20 countries have failed to do so.

The second part of this series will look at the international debate on tax evasion.

June 8, 2014

Why global efforts to fight black money have been ineffective

Despite treaties compelling tax havens to share information, evaders simply moved their deposits to destinations not covered by such agreements. What is the way forward?

Indians are not the only ones outraged at the idea of rich people evading taxes and hiding their wealth in secret Swiss bank accounts.

So are the French, the British, the Americans, the Germans and others.

Under pressure from their citizens after the financial crisis of 2008, the G20 countries – a club of the major economies of the world, including India – compelled offshore tax havens to sign bilateral treaties to share information on bank deposits held by their nationals. More than 300 information exchange treaties were signed between April and December 2009.

But these treaties were not very successful in bringing back the funds, a new study has found.

Neils Johannsen of the University of Copenhagen and Gabriel Zucman of the London School of Economics studied bilateral bank deposit data for 13 major tax havens from 2003 to 2011.

They found that the treaties had "a modest impact on bank deposits in tax havens: a treaty between say France and Switzerland causes an approximately 11% decline in the Swiss deposits held by French residents."

Second, rather than repatriating funds, "tax evaders shifted deposits to havens not covered by a treaty with their home country. The crackdown thus caused a relocation of deposits at the benefit of the least compliant havens."

Part of the reason why the treaties failed to work was that they provided for information “upon request”, which meant governments had to first gather leads on possible tax evaders to identify accounts for which they could place requests. Given the nature of tax evasion, gathering such information was extremely difficult.

Another reason for the failure was that the treaties were bilateral – signed between two countries – and hence allowed for movement of countries not covered by treaties.

Johannsen and Zucman suggest that instead of bilateral treaties, "a comprehensive network of treaties providing for automatic exchange of information" might help make tax evasion impossible.

Network of treaties

This is precisely the direction in which the world is moving.

It started with the United States of America passing the Foreign Account Tax Compliance Act in 2010. Under FATCA, foreign financial institutions must report information on accounts held by US taxpayers or risk being charged a punitive 30% withholding tax on payments cleared through the US banking system.

FATCA was initially greeted by consternation – it was seen as an American law with extra-territorial reach. But with America offering to share reciprocal information, several countries lined up to sign intergovernmental agreements. As many as 48 countries – including India – have either signed or agreed to sign the agreement.

Last year in April, inspired by the FATCA, France, Germany, Italy, Spain and the UK decided to exchange information amongst themselves. They further endorsed the proposal of the Organisation for Economic Cooperation and Development for a new global standard for automatic exchange of tax information.

The OECD defines automatic exchange of information as "systematic and periodic transmission of 'bulk' taxpayer information" by the source country to the residence country of the account holder.

“With the signing of the OECD Ministerial declaration in May 2014, more than 60 jurisdictions have committed to implement the new single global standard on automatic exchange of information," said Monica Bhatia, head of the OECD's Global Forum on Transparency and Exchange of Information for Tax Purposes , in an email to Scroll.in."These jurisdictions include all OECD countries, all G20 countries and other significant financial centres such as Switzerland, Singapore, Liechtenstein and the Cayman Islands. More countries are expected to commit to this standard over the next few months. This ensures that the standard will be truly international and implemented across the globe

What does this mean for India, which has agreed to adopt the standard?

“The advantage of automatic exchange is that India would receive the information on its residents automatically without having to make a specific request and without having first identified instances of non-compliance," Bhatia said. "This is expected have a significant deterrent effect on taxpayers who seek to hide money abroad and will help enforcement efforts of the tax administration.”

Disadvantage for developing countries

But there are concerns that the condition of "reciprocity" in such exchanges would disadvantage developing countries. "Anyone who participates in AEOI has to put on place the legal framework and the infrastructure to collect and provide information to treaty partners as well the infrastructure to receive and use the information received," she said. "One of the most important requirements is the ability to safeguard the information exchanged and ensure its proper use."

Creating such infrastructure might be costly and unaffordable for poorer countries, which could get excluded. This is problematic – for one, more illicit funds flow out of developing countries than the developed ones.

“To understand why reciprocity is a problem, consider first how many wealthy Nigerians are likely to stash assets secretly in Switzerland – then consider how many wealthy Swiss are likely to have located their secret stashes in Nigeria," says the UK-based advocacy group, Tax Justice Network, in its critique of the OECD standard. "Nearly all the active tax havens are located in rich countries, and the flow of illicit money is in one direction only: from poor countries to rich."

Two, the failure to include all countries would leave open room for illicit funds to move to places that have not participated in the new standard.

Lastly, as Tax Justice Network points out, the new standard does not fully take on arguably the biggest vehicles of tax evasion: trusts and foundations that hold assets and make investments without disclosing the names of those who have put in money. "The standard only requires a single settlor to be named, instead of all settlors and contributors of assets to trusts." To end the tax evasion of the rich, TJN says the veil of secrecy of trusts and foundations must be lifted.

What does this mean for India's fight against black money?

The flow of illicit money is an international problem and cannot be tackled by one country alone. A new global architecture is needed to fight illicit funds.

But while that architecture takes shape, there is something that India can do on its own: reform and regulate the sectors within its domestic economy that create, multiply and store black money. That neither requires an international treaty nor a high-powered special investigative team.

The first story in this series examined where India's black money is stashed away: not in Switzerland, as is popularly believed, but in real estate in the subcontinent.