Govt. of India should come clean, reveal it all, without dodging information citing some privilege of Parliament.

Is India aware of this law by the Federation of Switzerland?

http://www.admin.ch/opc/en/classified-compilation/20100418/201102010000/196.1.pdf Federal Act

on the Restitution of Assets illicitly obtained by Politically Exposed Persons Restitution of Illicit Assets Act (RIAA) of 1 October 2010 (Status as of 1 February 2011)

This is a Swiss law which allows for the seizures of the assets of persons who have been accused of obtaining such assets in other countries (including state coffers) through unlawful means. It came into force on 1 February 2011.

The Govt. of India should promulgate an ordinance ratified later by Indian Parliament as an Act declaring the assets of Indians held in tax havens to be nationalised property as the nation's development imperative and should revert forthwith into the Indian financial system. Such reverted monies will be dealt with under Indian laws.

State categorically that holding Indian illicit wealth abroad in tax havens is TREASON not mere violation of tax laws.

What privilege is greater than the privilege of 1.25 billion Bharatiyas?

NaMo's promise to get back kaala dhan काला धन and distribution to poor is not an empty promise. It is a solemn vow to be fulfilled.

Do it, NaMo. First, nationalise all monies held illicitly held abroad, not merely in Swiss banks but also in other tax havens all over the world.

What is the problem in declaring the monies to be brought back into India's financial system?

Why not require all Indian MNCs to operate all their accounts from India's financial institutions?

Indians should hold monies in Indian institutions. PERIOD. Foreign accounts should be an exception and justified in EACH CASE to the RBI.

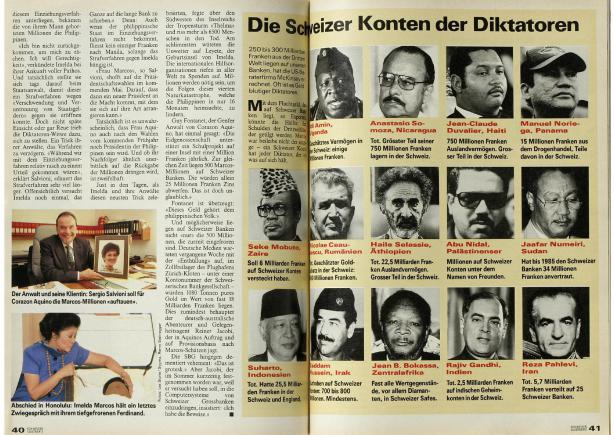

See the foreign monies reported of Rajiv Gandi by Schweizer Illustriete.

SIT led by Justice Shah should start the investigations from this report from an illustrated magazine and track down Rs. 90 lakh crores attributed to SoniaG family by Senior Advocate Ram Jethmalani.

Invite Ram Jethmalani to provide evidence, he has promised to work with SIT. Invite Dr. Subramanian Swamy and Gurumurthy; they have given leads of information in public media to be followed up by Justice Shah SIT.

It will be a travesty of justice if the SIT does not bite the bullet citing some political reasons or delays in administrative letter-writing exercises.

Kalyanaraman

Restitution of Illicit Assets Act (RIAA)

Bern, 01.02.2011 - The Federal Act on the Restitution of Assets of Politically Exposed Persons obtained by Unlawful Means (RIAA) came into force on 1 February 2011. It governs the freezing, forfeiture and restitution of the assets of politically exposed persons (PEPs) in cases where a request for mutual assistance cannot succeed in the requesting state due to the failure of its judicial system. This new law confirms Switzerland’s position of international leadership when it comes to the restitution of assets of illicit origin.

The idea of such a law grew out of the difficulties faced by the Swiss authorities in efforts to return assets frozen in Switzerland following the failure of criminal proceedings at the national level, as in the cases of Mobutu and Duvalier.

The new act governs the freezing, forfeiture and restitution of the assets of politically exposed persons and their close associates in cases where a request for mutual assistance in criminal matters cannot produce an outcome owing to the failure of state structures in the requesting state. The RIAA provides a solution that is subsidiary to the Swiss Federal Act on International Mutual Legal Assistance in Criminal Matters. It provides for an alternative solution to that of criminal proceedings for the restitution of assets in that it makes possible the confiscation of assets that are clearly of illicit origin without need for the prior conviction of the PEP concerned.

To accomplish this, the Federal Council can instruct the Federal Department of Finance (FDF) to take legal action before the Federal Administrative Court for the forfeiture of frozen assets. The subsequent judgement, against which an appeal can be submitted before the Federal Supreme Court, permits if necessary the forfeiture of assets of unlawful origin which have been frozen pending their restitution to their state of origin by means of a transparent procedure, unless the legal origin of the assets has been demonstrated by the PEP.

The assets thus forfeited will then be returned by the Confederation to the country of origin for the benefit of the population through the financing of programmes of public interest. The application of this law will help to strengthen the rule of law and to combat impunity.

Certain heads of state and high-ranking government officials enrich themselves at the expense of the state and, by embezzling public monies, hinder the development of the national economy. These so-called "potentate funds" often leave the country of origin and find their way to international financial centres. It is in the fundamental interest of Switzerland that such assets of criminal origin not be invested in the Swiss financial centre.

Switzerland reacted to this situation at the end of the 1980s following a number of high profile cases (Marcos, Abacha, Montesinos). Thanks to its proactive policy for the restitution of such assets, Switzerland has established itself as a leader in this context. In concrete terms, Switzerland has developed a two-pronged system based on prevention and mutual legal assistance. The prevention aspect has been strengthened through cooperation with the banking sector. The Federal Act on the Prevention of Money Laundering is one of the main instruments of this two-pronged system which imposes due diligence obligations ("know your customer") on the banks and other financial service providers. The latter are also under an obligation to report any suspicious transactions. The second "prong" is based on the Federal Act on International Mutual Legal Assistance in Criminal Matters which allows for cooperation with other states to enable the seizure and restitution of assets of illicit origin. If, despite the various precautionary measures, illicit assets do find their way to Switzerland these must be identified and returned to their country of origin.

On the whole, this system has produced good results. Over the past 15 years it has enabled the Confederation to return some CHF 1,700 million -- far more than any other financial centre. This new Act completes the instruments at Switzerland's disposal and confirms the Confederation's position as leader and pioneer for the restitution of assets of illicit origin.

NaMo, nationalise Rs. 120 lakh crore black money, ask Justice Shah SIT on Black Money to draft ordinance. Assocham asks for 6 month amnesty.

Published: June 24, 2014 01:02 IST | Updated: June 24, 2014 01:02 IST

Institute refutes FinMin’s claim of incomplete study on black money

The National Institute of Public Finance and Policy (NIPFP) has refuted the Finance Ministry’s reported claim that the studies commissioned by the UPA Government to estimate the amount of black money in India and held overseas by Indians are yet to be completed.

High-level Ministry sources also confirmed to The Hindu that at least the first drafts of these studies commissioned to the other two agencies — the National Council of Applied Economic Research (NCAER) and the National Institute of Financial Management (NIFM) — are available with the Finance Ministry.

Last week, the Finance Ministry was reported to have said in reply to an RTI query that the studies the UPA Government had commissioned were yet to be completed.

Responding to the reports, the NIPF, an autonomous institute of the Finance Ministry, issued a press note on Monday that said the Finance Ministry had informed it in March 2014 that it would treat as final the report it had submitted in December 2013.

The UPA Government had in March 2011 commissioned three studies on estimation of unaccounted income or wealth, both inside and outside the country. These three studies were expected to be completed by September 2012.

“Further details cannot be made available at this point of time as the information is exempt under Section 8 (1) (c) of the RTI Act, 2005, since the report and action taken thereof is yet to be submitted to Parliament,” the Finance Ministry was reported to have said in the RTI reply.

The said Section bars information “disclosure of which would cause a breach of privilege of Parliament or the State Legislature”.

The press note clarification from the NIPF could come as an embarrassment for the Modi Government that had on May 27, in compliance with a Supreme Court direction, constituted a SIT on black money.

The different estimates on the quantum of black money range between $500 billion to $1,400 billion. A study by Global Financial Integrity has estimated the illicit money outflow to be $462 billion. “These estimates are based on various unverifiable assumptions and approximations. [The] Government has been seized of the matter and has, therefore, commissioned these institutions to get an estimation and sense of the quantum of illicit fund generated and held within and outside the country,” the Finance Ministry had said in a press statement issued on May 29, 2011.

http://www.thehindu.com/news/national/institute-refutes-finmins-claim-of-incomplete-study-on-black-money/article6142813.ece?homepage=true&ref=relatedNews

Published: June 23, 2014 01:43 IST | Updated: June 23, 2014 01:46 IST

Swiss list of Indians a major breakthrough: SIT chief

Image may be NSFW.

Clik here to view.![A file photo of Justice M.B. Shah. A file photo of Justice M.B. Shah.]()

Clik here to view.

PTIA file photo of Justice M.B. Shah.

"We will act on this list as per law and continue with our investigation": Justice Shah

Justice M.B. Shah, chairman of the 11-member Special Investigation Team on black money, said the Switzerland government’s move to share with India a list of its citizens who are suspected to have stashed away untaxed wealth in Swiss banks will come as a major breakthrough in its ongoing investigation.

“Of course, we will positively receive the information on the Zurich list. This information will help us assess the quantum of black money stashed away by Indians in that country,” Justice Shah, a former Supreme Court judge, toldThe Hindu on Sunday over the phone.

Following a Supreme Court direction, Prime Minister Narendra Modi on May 27 constituted the SIT on black money. The team has Justice Arijit Pasayat, also a former Supreme Court judge, as its vice-chairman. Justice Shah said a meeting of the SIT would be called soon to discuss the new development.

“We will act on this list as per law and continue with our investigation,” Justice Shah said from his home at Ahmedabad.

Justice Shah was reacting to a PTI story from Zurich, which said Switzerland had prepared a list of Indians who had stashed away untaxed wealth in Swiss banks and was ready to share the details with New Delhi.

“These individuals and entities are suspected to have held untaxed money in Swiss banks through structures like trusts, domiciliary companies and other legal entities based out of countries other than India,” the official told the news agency.

He refused to divulge the identity of these persons and entities, as also the quantum of funds held by them in Swiss banks, citing confidentiality clause of the bilateral information exchange treaty between the two countries.

“If the government is really serious about black money, it should crack down on tax haven companies dealing in laundered money from anonymous sources. Even the SIT was formed on the insistence of the Supreme Court and not the government,” said senior lawyer Prashant Bhushan.

http://www.thehindu.com/news/national/swiss-list-of-indians-a-major-breakthrough-sit-chief/article6139498.ece

Published: June 23, 2014 23:31 IST | Updated: June 24, 2014 01:05 IST

We’re writing to the Swiss for black money list: Jaitley

Image may be NSFW.

Clik here to view.![Union Minister for Finance Arun Jaitley, addressing the media in New Delhi on Monday. Photo: Ramesh Sharma Union Minister for Finance Arun Jaitley, addressing the media in New Delhi on Monday. Photo: Ramesh Sharma]()

Clik here to view.

The HinduUnion Minister for Finance Arun Jaitley, addressing the media in New Delhi on Monday. Photo: Ramesh Sharma

The Swiss Ministry of Finance has denied move to share details

Union Finance Minister Arun Jaitley said on Monday that the Modi government was writing to the Swiss authorities to share details of Indians holding black money in banks there.

“Though we haven’t received any communication from the Swiss authorities, we are today [Monday] writing to them so that details with regard to whatever information the authorities have can be expedited and the cooperation between the Swiss authorities and the government of India can bring fruitful results,” Mr. Jaitley told reporters.

India had earlier accused Switzerland of “providing protection to taxpayers found to have evaded Indian taxes” and seriously undermining India’s efforts in tackling offshore tax evasion and stashing of unaccounted income abroad.” Zurich had declined to share account details of certain Indians with accounts at HSBC’s branches in Switzerland in cases where Indian investigators had found “incriminating evidence of tax evasion”.

On Sunday, it was reported that Switzerland had prepared a list of Indians suspected to have stashed untaxed wealth in Swiss banks and that the details were being shared with Indian government.

The Swiss Finance Ministry statement said that after the high-level Swiss delegation met its Indian counterparts in New Delhi in February 2014, no further official meeting had taken place.

The Swiss government has been refusing to share details about the Indians named in this ‘HSBC list,’ which was stolen by a bank employee and later found its way to tax authorities in various countries, including India.

Despite repeated requests from India, Switzerland has maintained that its local laws prohibit administrative assistance in matters where information has been sourced illegally, including through stolen lists.

http://www.thehindu.com/news/national/were-writing-to-the-swiss-for-black-money-list-jaitley/article6142705.ece