Image may be NSFW.

Clik here to view.

Image may be NSFW.

Image may be NSFW.Clik here to view.

Published: January 3, 2013 23:36 IST | Updated: January 4, 2013 01:31 IST

U.S. treasury bonds in Tirupur likely fake

Special Correspondent

Image may be NSFW.

Clik here to view.

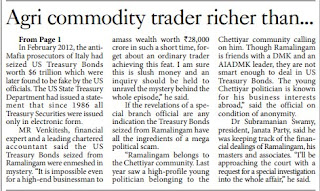

The Hindu A view of agricultural trader T.M. Ramalingam's house in Dharapuram, Tamil Nadu, where the I-T department seized U.S. treasury bonds worth $ 5 billion. Photo: S. Siva Saravanan

The “U.S. treasury bonds” with a face value of $5 billion seized by Income-Tax officials from a businessman in Tirupur district are most likely fake since the U.S. Treasury Department has largely dispensed with issuing paper T-bills and has certainly not issued any with a denomination as high as $1 billion. Indeed, in February 2012, after police in Italy seized fake U.S. bonds worth a whopping six trillion dollars, American officials told the media the U.S. does not sell a $1-billion treasury bond.

The Italian haul was similar to but much larger in scale than the recent seizure of five U.S. ‘international bills of exchange’, each with a face value of one billion dollars, from T.M. Ramalingam (46) at Dharapuram in Tirupur district of Tamil Nadu. While the I-T authorities say they are still trying to verify the authenticity of the documents, recent media reports suggest that use of fake U.S. bonds to make bogus investment pitches and defraud individuals and even banks around the world is not uncommon. The Reuters news agency, in fact, issued a picture of the fake U.S. treasury bond with a one-billion dollar value. Authorities in Italy then said such fake documents were often used as collateral for loans and other transactions.

According to The Los Angeles Times, U.S. Customs Enforcement has warned the public against such bogus bonds in circulation. Meanwhile, as taxmen continued their probe into the seizure of the purported U.S. treasury documents from his house, Mr. Ramalingam, who trades in agricultural products, claims he has complied with all legal requirements. When reporters of The Hindu met him at his residence on Thursday, he said, “I have complied with all procedures.” And, added that an inquiry was scheduled in Chennai for Friday before the Income Tax department. I-T officials did not rule out Mr. Ramalingam being duped into purchasing fake bonds as he had said he was planning to use the bonds to fund his ambitious plan to set up a petroleum product refinery.

http://www.thehindu.com/news/national/us-treasury-bonds-in-tirupur-likely-fake/article4270006.ece?homepage=true&css=print

Published: January 3, 2013 23:38 IST | Updated: January 4, 2013 00:25 IST

Are U.S. treasury bonds seized in Tirupur genuine, ask legal experts

R. Sivaraman

While the Income Tax department is probing the authenticity of U.S. treasury bonds seized from a person in Tirupur, legal experts have expressed doubts over the genuineness of the documents, as well as the legality of an individual holding such high-volume bonds in the name of investment.

P.H. Arvindh Pandian, advocate specialising in company law, expressed surprise over the individual’s possession of such a huge quantity of U.S. bonds worth billions and took the view that this would be against norms.

He said: “It is surprising that an individual is holding such a staggering amount that too in U.S. treasury security bonds which is prima facie a violation of the Foreign Exchange Management Act [FEMA] and RBI guidelines.” Normally an Indian resident is entitled to invest up to $ 200,000 a financial year. In this case, this appears doubtful as the bond apparently is a debt entity. The whole transaction can be examined only after ascertaining the genuineness of these bonds.

Lawyers dealing with company affairs note that they have never seen any company showing as investment any U.S. or other foreign country’s security bonds in its balance sheet.

Clarifying the legal position further, K. Ramasamy, an experienced lawyer who has dealt with Income Tax and FEMA Act cases, noted: “Any transaction in foreign exchange with another country is governed by the RBI Act. Hence, any investment in the foreign country by a resident in India can be made only with specific or general permission of the RBI. Any transaction in Foreign Exchange is also governed by the FEMA and rules made there under. If any transaction does not adhere to the Act and Rules it has to be construed as unlawful.”

“This is the first time I am coming across such a large seizure. It has to be verified whether such bonds have originated from the source lawfully or otherwise whether they are fake, which is a possibility that cannot be totally ruled out,” he said.

To a question whether it is possible for an individual to have $ 5 billion U.S. federal securities bond, K. Kumar, senior advocate and former Special Counsel for the Enforcement Directorate, said the purchase of federal securities was subject to a set of conditions.

General permission has been granted to persons (individual) resident in India for purchase / acquisition of securities out of funds held in the Resident Foreign Currency (RFC) account maintained in accordance with the Foreign Exchange Management (Foreign Currency Account) Regulations, 2000. Resident individuals can also acquire foreign securities without prior approval as a gift from a person resident outside India.

Under the law, a resident Indian can remit up to $ 200,000 per financial year under the Liberalized Remittance Scheme (LRS) for permitted current and capital account transactions including purchase of securities from the foreign currency resources outside India. Individuals, institutions and governments are allowed to invest in U.S. Treasury Bonds. “While the minimum investment is $100 there is no cap on the maximum,” Mr. Kumar said.

“If the source of funds is not explained in accordance with law the assessee is liable to be prosecuted under the provisions of the IT Act. Such cases can also be referred to other Central revenue departments for action under various provisions of the said enactment. Further, the property in the hands of the assessee or his associates is also liable to be confiscated if the prosecution results in conviction.”

http://www.thehindu.com/news/national/are-us-treasury-bonds-seized-in-tirupur-genuine-ask-legal-experts/article4270003.ece